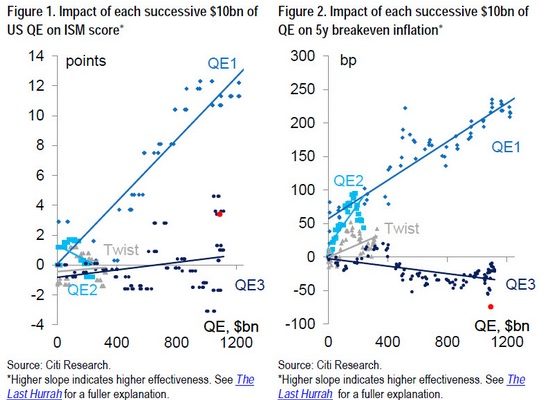

We’re now officially two weeks into the ECB’s trillion euro PSPP wherein Mario Draghi will do his best Haruhiko Kuroda impression by monetizing all the government debt he can find and in the process likely discover what should have been clear from taking a look at how effective previous iterations of unbridled money printing have turned out to be when it comes to stimulating growth and boosting inflation expectations:

Essentially, the more you do it, the less effective it is, and when it comes to inflation expectations, the results have been underwhelming to say the least. Nevertheless, Mario Draghi and other ECB officials like chief economist Peter Praet have been busy explaining just how committed they are to asserting “monetary dominance†by purchasing assets forever if necessary. Here’s governing council member and Bank Finland chief Erkki Liikanen:Â

“The large-scale asset purchases will be carried out at least until end-September 2016 and in any case until the Governing Council judges the pace of inflation is returning sustainably to a level in line with the price-stability objective [and] we are committed to that resolutely and without doubt.â€Â

Meanwhile, Q€ is distorting euro money markets and effectively stripping the market of its ability to signal anything at all about risk. Here’s what we said earlier this month on the subject:Â

In a nutshell: short-end core paper will trade below -0.20%, extreme supply/demand imbalances will cause general collateral rates to trade through the depo rate, money market fund yields will turn decisively negative testing investor patience, and central banks had better make good on promises to make some of their inventory available for lending or risk impairing the functioning of the repo market (never a good idea).Â

It’s in this context that some have begun to suggest that the ECB has created a bubble in eurozone government debt that could end very badly. According to AXA’s Nick Hayes, the EGB bubble may end in a 2000 Nasdaq-style collapse. Here’s more via Bloomberg:Â