Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes after today’s open.

Global sentiment was boosted for the second day by a rebound in energy shares as oil prices rose, with Brent regaining the $51 level and reverse all of last week’s losses, after U.S. fuel inventories declined and Saudi Arabia cut supplies of crude to Asia more than expected.

The MSCI’s gauge of global stock markets was up 0.1 percent, bringing their gains for the year to nearly 10 percent, and into fresh record territory. After starting off deep in the red, the Shanghai Composite managed to recover and close green, despite another tumble in iron ore on SGX AsiaClear in Singapore, where it fell as much as 4.5% to $59 a ton, the lowest since October amid a clampdown on leverage in China, the top consumer, and expanding global supply.

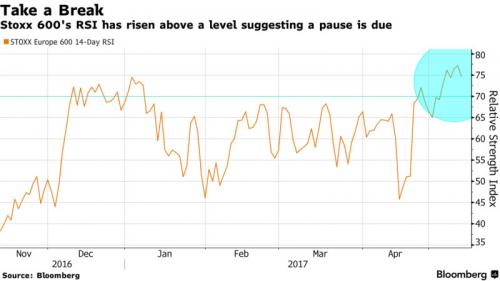

European stocks dropped for the first time in three days as a rebound in mining and energy shares failed to offset a broader negative mood at least in early trading. The Stoxx Europe 600 Index slipped following a raft of corporate results. Companies including Telefonica, UniCredit and Maersk reported good earnings, but the index this week climbed to near the highest on record and as the Bloomberg chart below shows, it is now massively overbought.

European gov’t bond yields rose as rising oil prices reinforced expectations inflation would pick up, and raised risks of a hike or taper by the ECB. Those expectations also boosted the euro, which rose 0.3 percent against the dollar to $1.0868.

The problem for traders is a familiar one: while company earnings (if not so much U.S. data lately) are painting a picture of robust global growth – mostly on a non-GAAP basis of course – and political risk has eased following France’s presidential election, investors are “showing a lack of conviction as global equities trade at record-high levels and volatility evaporates. The path for interest rates will remain a major focus, with the Bank of England meeting today amid growing bets for a Fed increase in June and talk of tapering by the European Central Bank.”

Today, the paradox of “good news is bad news” was summarized by Ben Kumar, a London-based investment manager at Seven Investment Management, who said that “Investors are trying to make sense of contradictory forces. Everyone’s quite optimistic and companies are making lots of money and this is all good stuff, and they start thinking about Mario Draghi and the taper and how much that will hurt.â€

In a note overnight, Goldman warned that despite the Fed’s two rate hikes in the past 5 months, financial conditions are the easiest in two years, which may prompt the Fed to “shock” markets.

Also of note: the reflation trade appears to have returned again, if only for the time being, and in addition to TSYs and Bunds, Japanese JGBs saw upward pressure on yields despite the strongest bidside demand for 30Y paper in the overnight auction in months.

In FX, the dollar weakened against a basket of major currencies, though most major currency pairs were all holding in tight ranges. Earlier in the Asian session, the New Zealand dollar sank as much as 1.5 percent after the country’s central bank stuck with a neutral bias on policy, warning markets they were reading the outlook wrong and expressing approval of the currency’s declines this year.

As SocGen’s Kit Juckes writes, “overnight currency drivers have been a pretty eclectic collection of unrelated developments. The biggest mover is the NZD which plunged to an 11 month low, weakened by the RBNZ’s policy decision, which left rates on hold and shows no sign of wanting to act any time soon. The second biggest mover is the Canadian dollar, undermined by Moody’s downgrading six banks on concerns about private sector debt. The Korean won was the main appreciating currency, rising with the equity market on anticipation of easier fiscal policy. And the final mover (apart from these four, very little happened) is the Australian dollar, down as iron ore prices fall again (a move which has weakened Chinese equities, too). The bounce in oil prices – Brent hit $51/bbl in early trading – is worthy of mention too.”

Elsewhere, “EUR/USD, USD/JPY and EUR/JPY for that matter, are marking time after recent moves. Mario Draghi was given a plastic tulip but didn’t take the bait and remained steadfastly dovish. EUR/USD needs Bund support and while both EUR/USD and EUR/JPY are a buy here, patience will be needed. The yen has fallen significantly on low vol and rising yields elsewhere. There is no data due today in the US and only one speaker (Dudley, this morning, in Mumbai).”

Oil rose after posting the biggest advance this year on Wednesday as U.S. crude stockpiles fell by more than twice what had been forecast, declining further from record and easing glut. EIA data showed stockpiles -5.25m bbl last week, the 5th weekly drop and biggest fall this year; compared to a -2m bbl median estimate in Bloomberg survey. Gasoline, distillate supplies also shrank, helping allay concerns over gaining U.S. crude output.

“The support that we see relates directly to the larger- than-expected draw on crude inventories†said Michael McCarthy, a chief market strategist at CMC Markets in Sydney. “U.S. demand is a bit of a surprise factor for the market. Daily production has climbed again and stockpiles still remain very elevated, so that suggests this rally might not last too long.â€