In a replica of Monday’s early trading, European shares are down, this time led by health-care stocks even as the Euro surges above 1.1050, the highest level since the US election. Asian equities rose, while S&P futures were little changed ahead of what is almost assured to be another record high in the Nasdaq. Meanwhile, the US dollar weakened for a fifth day after a WaPo report cited anonymous sources who said President Trump revealed classified information to Russia’s top diplomat.

The dollar fell against all its major peers after the Washington Post reported the president last week shared closely held intelligence with Russia’s foreign minister and ambassador. The greenback’s weakness translated to gains for precious metals, while crude rose a fifth day as Goldman Sachs released not one but two bullish reports on oil Monday, saying the willingness by Saudi Arabia and Russia to extend output cuts will likely sway other countries; of course the one that matters most, the US, was not mentioned.

According to Bloomberg, the market’s reaction to the latest in a string of controversies to dog Trump highlights growing uncertainty that the president will be able to deliver on plans to boost infrastructure spending and cut taxes. “That could prove key to investors, who are weighing historically pricey equities and ominously low volatility just as data from both China and the U.S. casts a shadow on global growth.” And yet we have yet to see any actual adverse impact on the S&P from these “controversies”, with E-minis trading 2,398.75, one tick in the green at this moment, essentially a new all time high..

“This sort of discussion is very new indeed and has caused a lot of U.S politicians to raise more concerns and that has clearly rippled into the markets,†said Andrew Milligan, head of global strategy at Standard Life Investments Ltd. in Edinburgh. “We can still buy into the interest-rate differentials arguments for the dollar but the arguments about fiscal stimulus and cross-border flows look more tenuous and have made us neutralize our bets on the dollar.â€

In equity markets, Asian stocks climbed to a fresh-two year high on the back of an overnight rise in Wall Street, while oil extended gains after major producers Saudi Arabia and Russia pledged to push for an extension of supply cuts into 2018. Investors in regional equities, however, are growing increasingly wary as valuations look stretched and with the latest rally taking place in thin volumes and led by just a few sectors. Asian regional stock markets were largely mixed with Chinese stocks leading laggards and Thailand among the best performing stock market of the year.

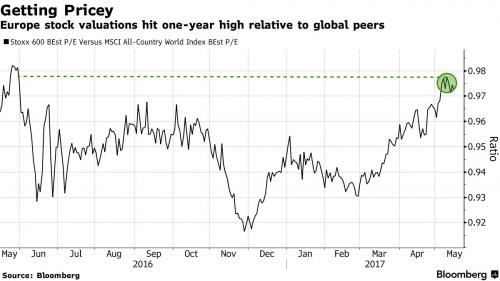

Europe is set to follow with index futures pointing to a mixed start. Concerns are rising that as some may be shunning the US, Europe is getting increasingly expensive in line with JPM’s recommendation to clients to start shoring European stocks.

“We are approaching a short-term resistance as the breadth of this rise is very unhealthy and the market momentum looks tired,” said Alex Wong, a fund manager at Ample Capital Ltd in Hong Kong, with about $130 million under management. In Hong Kong, the broader market rose to its highest level since June 2015 on the back of extended buying into Chinese lenders and market heavyweight Tencent before declining 0.3 percent.

With overall volumes declining and share valuations looking extremely stretched, investors are growing cautious. Hong Kong’s technology sector, for example, is the most expensive, trading at a price-to-earnings multiple of more than 42 times. The MSCI index of Asia-Pacific shares ex-Japan was flat after hitting its highest level since June 2015 in opening trades.

But going back to the big story overnight, it was all about FX, and specifically the surge in the euro, which extended its recent gains to levels last seen during the US presidential election amid concerns by dollar bulls that political turmoil over the Atlantic will push back the implementation of much-anticipated reforms by the Trump administration.

The dollar, as measured by the Bloomberg Spot Index, dropped for a fifth day, its longest losing streak in almost two months. The euro rose above the high seen after the final round of the French presidential elections as hedge funds and macro investors added fresh longs, according to foreign-exchange traders in Europe. The common currency gained as much as 0.7 percent to $1.1050 as of 11:00 a.m. London time, its strongest level since the aftermath of the U.S. elections.

The common currency has risen by 1.7 percent since Friday, and given one-week realized volatility traded near a 2 1/2 year low hit on April 19, further gains may take longer to materialize. Take-profit offers were seen near $1.1050 and $1.1100, said the traders. Interbank desks were looking to fade a move below $1.10 instead of chasing the market higher. Still, the short-to-medium term remains constructive for euro bulls. Volatility smile analysis on the one-week tenor shows how a rise in demand for euro calls has outweighed that for puts since the release of U.S. soft data on Friday. With a lack of hefty nearby expiries up to Wednesday, focus could be drawn toward options worth 4 billion euros rolling over at $1.10 on Thursday. The dollar fell against most of its G-10 peers as U.S. President Donald Trump’s top foreign policy advisers raced to contain political damage from a report saying he revealed sensitive classified information to Russia’s top diplomat during an Oval Office meeting last week

Oil steadied around the $52 per barrel level after hitting its highest level in more than three weeks on Monday, after Saudi Arabia and Russia said that supply cuts needed to last into 2018, a step towards extending an OPEC-led deal to support prices for longer than first agreed. [O/R] Global benchmark Brent crude rose 0.4 percent to $52 per barrel. U.S. West Texas Intermediate (WTI) crude futures were up 0.4 percent at $49.03 per barrel.

Brent crude has gained nearly 9 percent over the last week though some analysts were skeptical about the durability of the rally despite the proposed supply curbs. “That is going to be easier said than done, it appears, with U.S. production running at its fastest pace since August 2015 and data yesterday confirming that Chinese growth momentum continues to moderate,” ANZ strategists wrote in a daily note.