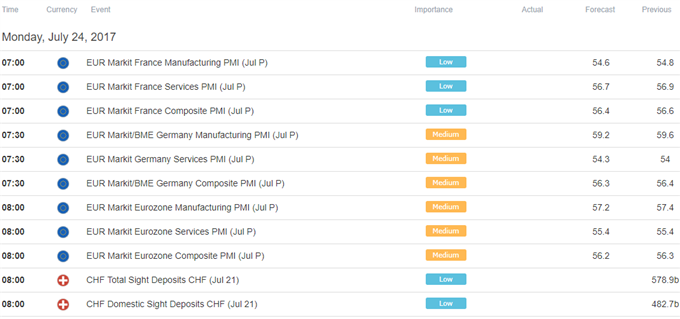

The preliminary set of July’s Eurozone PMI surveys headlines the data docket in European trading hours. Consensus forecasts suggest the pace of factory and service sector activity growth will slow for a second consecutive month to register at the weakest since February. An even softer result may be in the cards if the outcomes echo a recent string of disappointing regional statistics.

What this might mean for the Euro is an open question. The single currency has managed remarkable resilience recently, shrugging off a run of disappointing news-flow and a pointedly dovish ECB. If soft data proves to weaken it, a larger reversal may be in the cards in the days to follow as a level of sensitivity to baseline fundamentals is re-established.

Upcoming comments from ECB Director General for Economics Frank Smets will be weighed up in a similar fashion. He might offer a flavor for the direction of the forthcoming official economic forecasts update due in September. If he echoes the dovish tone of ECB President Mario Draghi, the recently popular argument for near-term tightening will be harder to defend, making the Euro still move vulnerable.

The Yen traded broadly higher as Japanese shares started the trading week on the defensive, fueling gains in the perennially anti-risk currency. The New Zealand Dollar turned lower as front-end US Treasury bond yields ticked higher. The move seemed corrective after the so-called Kiwi emerged as a standout beneficiary of return-seeking capital flows triggered by fading Fed rate hike bets last week.

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.