Well, we’ve entered a Brave New World now where putting money into the ECB COSTS YOU 0.2% per year.  That’s right – if you give them $1,000,000,000 to hold for a year, they will give you back just $998M – and people will do it!  Meanwhile, the refinancing rate at the ECB has been cut from 0.15% to 0.05% – so borrowing $1Bn for a year will only cost the Banksters $50,000 in interest while they use it to manipulate the equity and commodity markets. Â

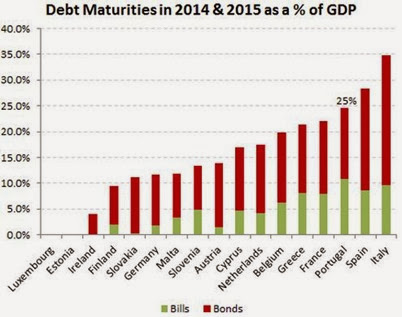

As you can see from the top chart, this is making a complete joke out of the Euro, but that’s what the ECB wants as member nations are Trillions upon Trillions of Euros in debt and the ECB’s moves serve to force rates lower (so debt can be rolled over cheaply) and allow countries to pay back maturing debt in Euros that are worth less (worthless?) than what they were borrowed at – saving the big 5 over $1Tn in 2014 alone. Â

Will there ever be consequences to this type of behavior?  Not, as I said on Tuesday, if everyone is doing it.  However, if some people stop while others go on – it could be BIG TROUBLE for countries that need to borrow money using a combination of worthless currency and negative interest payments.  What can possibly go wrong?  Everything. Â

That’s why, today, right now, we are once again shorting the Futures at 17,100 in /YM (Dow) and 2,005 on /ES (S&P) and 1,175 on /TF (Russell).  Yesterday we shorted the Nasdaq (/NQ) at 4,100 – a trade idea I outlined in the morning post for our subscribers – and that trade made $700 per contract by noon.  Not a bad day’s work, right? Â

We already made our Egg McMuffin money this morning in our Live Member Chat Room (and you can join the fun here) as we caught a $200 bullish move on the S&P (/ES) Futures and $400 on the Russell (/TF) Futures early this morning.  I made a call to get out ahead of the ECB announcement, as it was too risky and now we’re sticking with our plan and going short – but with very tight stops over our lines, as it’s likely to be a crazy day. Â