The new year is not even a week old and already the volatility fireworks are off, as well as the continued commodity derisking. But while for now US stocks continue to be an island oasis in a turbulent global sea where GDP forecasts decline every single day, the same can not be said about the Euro.

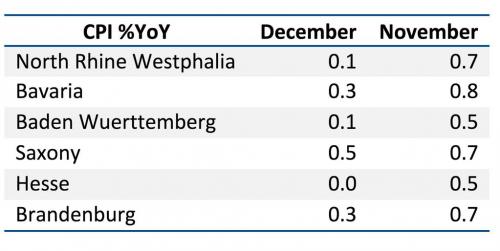

After crashing overnight to a 9 year low, and rebounding briefly, the Euro has continued to decline, and is now once again flirting with a key support level, this time 1.19, last reached during the May 2010 first Greek bailout. The catalyst, as usual, Greece which may or may not be leaving the Eurozone shortly, as well as ongoing bets on ECB QE following this morning’s regional German inflation data which declined once more and now hints at outright deflation in Europe’s strongest nation.

Â

Â

In any event, below 1.19 the freefall begins in earnest. As for Draghi’s outright monetization of debt, even the FT now reports that “Economists sceptical ECB bond-buying would revive eurozone.”

Speaking of freefall, things continue from bad to worse for Brent and WTI, which are both down 2% to fresh 5 years lows at last check, and Brent just hit $55 for the first time since May 2009. That this it taking place despite news that hours ago Saudi security personnel killed an alleged Jihadist gunman who blew himself up after being encircled near border post, shows just how substantial the downside momentum has become.

Meanwhile as the “developed” world is obsessing with Greece and Europe, where it “suddenly” realizes nothing has been fixed at all, China continues its relentless surge higher now that all chronic gamblers have left from Macau and rented out the UBS SHCOMP trading desk in Stamford, and as a result the Shanghai Composite Index surged once more, rising a whopping 3.6% to 3,350 in afternoon trading, led by industrials: the highest level since 2009. That this happens as copper falls for a third consecutive day, heading for its lowest closing price in more than 4 yrs, with NY copper down more than 1% to $2.7885 suggests that what a year ago was Chinese Bitcoin mania is now clearly raging in the stock market.