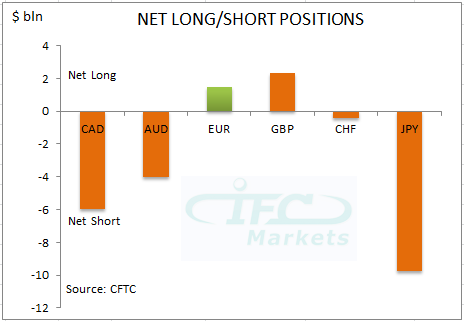

The latest report by Commodity Futures Trading Commission (CFTC) covering data up to Feb.18 shows that bullish sentiment is turning towards European major currencies like the Euro and the GBP but not the Swiss franc. At the same time the negative bias increases slightly with the CAD, the CHF and the Japanese Yen.

The Australian dollar net short position moderated somewhat to $4.01 billion.

The Euro had the biggest weekly change, returning to net long position amounting of $1.47 billion, though that does not mean anything since the Euro has been changing sides every week in the last months. The British pound has gradually built the largest net long position amounting of $2.32 billion while the Japanese Yen maintains the largest net short.

Traders have covered somewhat their short positions on the Australian dollar with the longer term trend still negative. The Japanese Yen bearish bias is not convincing due to small negative weekly changes as well as directionless USDJPY pair. The Canadian bearish sentiment strengthened by $0.72 billion with the exchange rate trend also negative and that increases chances for continuation of current circumstances.

CFTC Sentiment vs. Exchange Rate:

Net long / short positions:

Weekly change of Net L/S:

Long / short ratio: