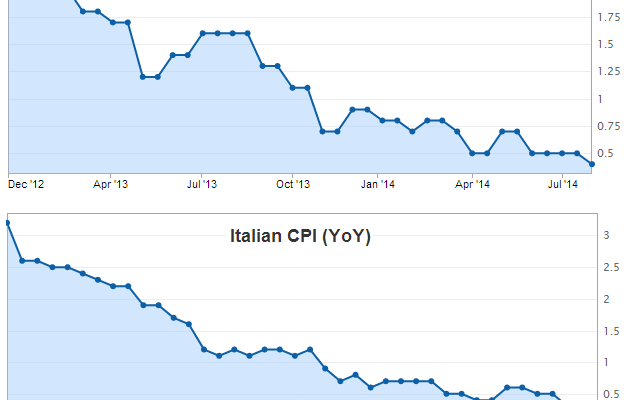

The ECB remains behind the curve in routing out the Eurozone’s persistent disinflationary trend. The area’s CPI is now below 0.5% on a year-over-year basis. Yesterday we saw German CPI hit new lows (see chart) and Italy’s inflation rate is now hovering just above zero.

Bloomberg: – Euro-area inflation unexpectedly slowed in July to the weakest in almost five years, underscoring the European Central Bank’s concerns that the economy is too feeble to drive price growth.Â

Inflation was 0.4 percent compared with 0.5 percent in June, the European Union’s statistics office in Luxembourg said today. That is the weakest since October 2009and below a median forecast of 0.5 percent in a Bloomberg News survey of 42 economists.Â

The centerpiece of ECB’s latest policy initiative, the TLTRO program, will take some time to fully ramp up. In the mean time the central bank is staring at rising risks of deflation, which may end up being extremely difficult to fight (as the BoJ painfully learned over the years). The Eurosystem’s (ECB) balance sheet continues to shrink to pre-LTRO levels resulting in tighter monetary conditions.

Eurosystem balance sheet (ECB)

The most expeditious action the central bank can take at this point is to further weaken the euro, and it has multiple tools to execute such policy. Whatever the case, the time for the ECB to act is now, not over the next couple of years.Â