EUR/USD intra-day analysis

Â

Â

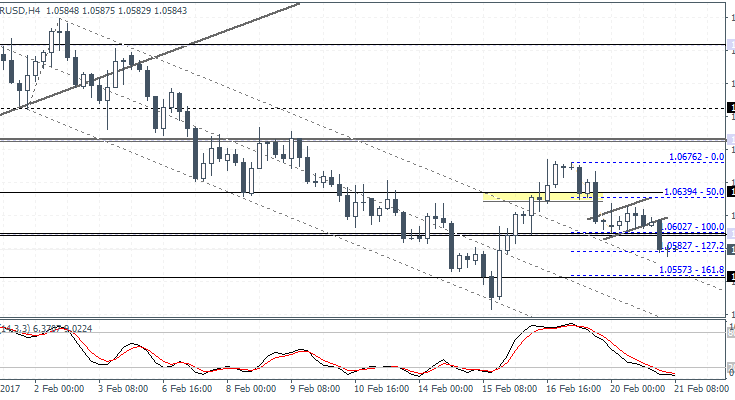

EUR/USD (1.0584): EUR/USD closed with a small bodied candlestick yesterday coming off the inside bar from Friday. A bearish break down from last Thursday’s low of 1.0591 could signal near term declines towards 1.0551. On the 4-hour chart, yesterday’s price action has resulted in a weak bearish flag pattern. With the support at 1.0602 – 1.0600 being breached by a strong bearish candlestick, EUR/USD could be seen extending the declines towards 1.0557 – 1.0555 which is a previously identified support level.

XAU/USD intra-day analysis

XAU/USD (1233.76): Gold prices posted gains yesterday but failure to continue higher resulted in a bearish start to the day as gold gave up nearly half the gains from yesterday. It was also a holiday short trading session for gold as well. The consolidation near 1241 – 1235 puts gold biased to the downside for a firm test of 1220 – 1217 support which previously acted as resistance. There is scope for prices to rebound off this initial support and rally back, but in this case, the rebound should potentially be pushing gold above the current resistance of 1241.00. Furthermore, a lower bounce in gold prices off the 1220 – 1217 support could mean an increasing possibility of a decline towards 1200 – 1196 support level.

USD/JPY intra-day analysis

USD/JPY (113.61): USD/JPY is attempting to breakout to the upside from the inside bar formed yesterday. This reversal also coincides with the daily chart’s breakout from the falling trend line connecting the 3 January 2017 high of 118.612 and 27 January high of 115.378. The immediate resistance is seen at 114.00, and only a breakout above this level will signal further upside in prices. USD/JPY could be seen targeting 118.00 in the near term if there is a successful breakout above 114.00.