- EUR/USD has been edging lower in reaction to stimulus, shrugging off Capitol storming.

- US data and the political fallout from the riots will likely shape trading before Fed hopes could boost the pair.

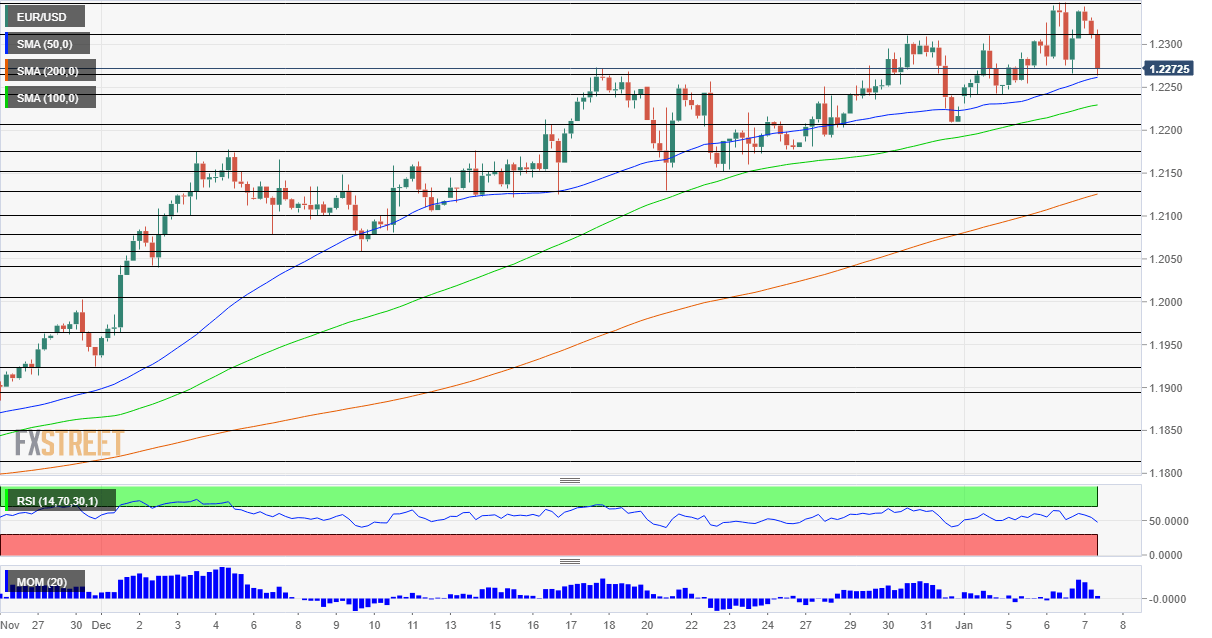

- Thursday’s four-hour chart is showing bulls hold an advantage.

The mob supporting President Donald Trump has failed in its coup attempt – and EUR/USD will likely fall short of ending the broad rally. The world has been digesting the extraordinary events on Capitol Hill – a well-organized group incited by the losing incumbent taking over parliament violently, and luckily failing to overturn the results. Congress certified Joe Biden as the winner early on Thursday.

Nevertheless, scenes reminiscent of the third world did little to sway markets as investors have seen the dramatic scenes as having no term impact on economics. The short physical capture of Congress has no impact – while the orderly takeover of the Senate by Democrats has a positive one.

Biden’s party secured effective control of the upper chamber after both Raphael Warnock and Jon Ossof won their runoff races in Georgia. That would enable Democrats to pass another generous stimulus package – yet probably insufficient to make market-unfriendly reforms. Dems will only have a slim 51:50 majority.

While prospects of further government spending bolstered markets, the dollar reaction was mixed. On one hand, the safe-haven greenback suffered a sell-off – but that was quickly replaced by flows stemming from rising bond yields. Expectations of massive bond issuance – to fund new expenditure, prompted investors to sell Treasuries. In turn, higher returns on US debt boosted the currency.

Nevertheless, any increase in the dollar may be temporary. It is essential to remember that the Federal Reserve is ready to buy more bonds if necessary. The Fed’s meeting minutes from the latest meeting showed some on the board are already eyeing additional monetary stimulus.

What could push the Fed into more action? In the immediate term, the answer depends on the job market. ADP’s labor figures disappointed with a loss of 123,000 positions, contrary to an increase that was expected.

Five factors moving the US dollar in 2021 and not necessarily to the downside

Will Friday’s official Nonfarm Payrolls also show a squeeze in hiring? That remains an open question, but bad news for American workers could turn into good news for dollar bears on expectations for Fed action.

Thursday’s economic calendar features jobless claims for the last week of 2020 and the ISM Services Purchasing Managers’ Index for December – a hint for the NFP. Devastating figures could boost EUR/USD, but there is a higher chance it would happen on Friday.

- ISM Services PMI Preview: Business optimism is fine but the dollar needs jobs

- US Initial Jobless Claims Preview: Rising unemployment undermines US recovery

Politics have somewhat overshadowed the pandemic that is raging on both sides of the Atlantic. COVID-19 cases, deaths on hospitalizations continue rising – with the US setting new highs on admissions.

In Europe, politicians are under pressure to accelerate the pace of vaccinations, which has been frustratingly slow. The European Medicines Agency (EMA) approved Moderna’s jabs, but evidence of a concerted effort to vaccinate the population are still to be seen.

More Coronavirus: Statistics, herd immunity, vaccine calendar and impact on financial markets and currencies

Overall, politics, data, and the disease are in the spotlight.

EUR/USD Technical Analysis

Euro/dollar has been falling, but momentum on the four-hour chart remains positive, and the currency pair trades above the 50 Simple Moving Average.

Bulls remain ahead.

Some support awaits at 1.2265, the daily low, followed by 1.2245, a low point early in the week, followed by 1.2210 and 1.2175.

Resistance is at 1.2310, the previous 2021 high, followed by 1.2350, which is emerging as a double top. The next cap is 1.24.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750