EURUSD Daily Pivots

| R3 | 1.1337 |

| R2 | 1.1266 |

| R1 | 1.1136 |

| Pivot | 1.1065 |

| S1 | 1.0934 |

| S2 | 1.0863 |

| S3 | 1.0731 |

Â

Â

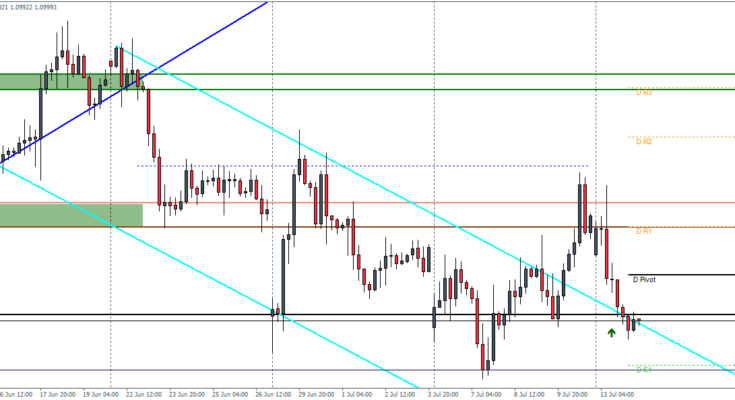

EURUSD (1.1): EURUSD struggled to break the resistance between 1.117 and 1.1135, thus seeing a strong reversal at this point. Price action fell back to retest the break out of the falling price channel at 1.10. EURUSD needs to establish support at 1.10 in order to attempt another test of resistance at 1.117. We expect that the resistance should give way in this next attempt which will pave way for a test to 1.1335 and 1.13575. Alternatively, to the downside, if 1.10 fails to support prices, EURUSD could dip back lower to test 1.09275 support. However, as price broke out from the falling price channel, we are biased to the upside.

USDJPY Daily Pivots

| R3 | 125.266 |

| R2 | 124.401 |

| R1 | 123.915 |

| Pivot | 123.05 |

| S1 | 122.565 |

| S2 | 121.7 |

| S3 | 121.214 |

USDJPY (123.2): USDJPY broke out from the falling price channel however a retest to the break out level near 122.65 remains pending. To the upside, resistance comes at 124 and any rallies could see price stalling at this point. A retest back to 122.65 will prove to offer a stronger case for a break above 124, which will then see USDJPY attempts to test previous highs of 125. To the downside, if price fails to establish support near the break out, USDJPY could dip lower down to the main support at 121.92.

GBPUSD Daily Pivots

| R3 | 1.5664 |

| R2 | 1.5625 |

| R1 | 1.5555 |

| Pivot | 1.5518 |

| S1 | 1.5448 |

| S2 | 1.5409 |

| S3 | 1.5339 |

GBPUSD (1.547): GBPUSD reversed strongly from the lows at 1.533 and rallied back up to the main resistance level between 1.551 and 1.5455. This also completes a retest to the break out from the main rising price channel at 1.555. Prices stalled above the main resistance and we expect another leg down in the near term, which could see another test to previous lows at 1.533. If 1.533 fails as support, GBPUSD could decline even further to test the next main support at 1.52.