- EUR/USD has been lagging behind its peers in gaining against the dollar.

- Concerns about covid variants and slow vaccine rollout may outweigh hopes for new US stimulus.

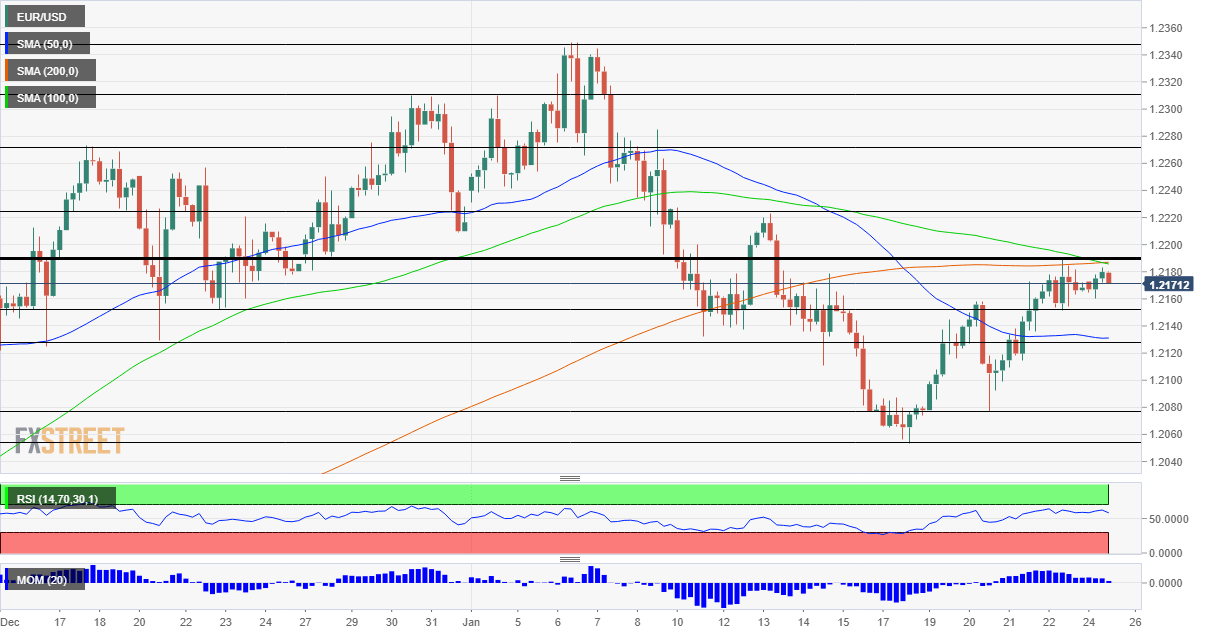

- Monday’s four-hour chart is showing that the pair faces robust resistance.

When even the slow-moving yen is gaining ahead of the euro – the common currency’s weakness is exposed. The safe-haven US dollar is on the back foot across the board as US President Joe Biden is advancing his $1.9 trillion relief program, yet the common currency’s advance is minimal.

Several issues weigh on the common currency. The COVID-19 vaccination rollout lags behind in the old continent amid slow distribution – and new manufacturing issues. After Pfizer told the EU that retooling in its Belgian plant will cause a delay, AstraZeneca made a similar announcement on Friday. The bloc has a substantial deal with the British pharmaceutical and the European regulator is set to approve it on Friday.

Apart from the vaccine delays, fears of new coronavirus strains are also of concern and may trigger another nationwide lockdown in France, the eurozone’s second-largest economy. The news from Paris comes after Berlin extended its restrictions through mid-February.

The German IFO Business Climate figures for January are set to show cautious optimism, despite these issues. Christine Lagarde, President of the European Central Bank, is scheduled to speak on Monday, but there is probably little that she can say to rock markets – she spoke on Thursday after the ECB left its policies unchanged.

As mentioned earlier, hopes of a substantial US stimulus package have been keeping markets bid and investors are eyeing the next developments from Washington. On the one hand, moderate Senators from both parties are pushing back against approving new expenditure, only a month after they greenlighted $900 billion of funds.

On the other hand, there are reports in Washington that Democrats are set to ram through the package via a “reconciliation” which would relieve them of the need to receive Republican support. Another option is quick approval of coronavirus-related funds while delaying other aspects of the suggested package, such as a hike to the minimum wage. Biden is scheduled to speak about American manufacturing later in the day.

Investors are also speculating about the Federal Reserve’s decision on Wednesday. The world’s most powerful central bank is set to leave its policy unchanged and reject an early tapering of its bond-buying scheme. Will Fed Chair Jerome Powell take the extra step of hinting at expanding the current scheme? Probably not – at least while markets remain upbeat.

Overall, while developments in Washington are mostly downbeat for the dollar, the euro is unable to fully capitalize on them – and that may lead to a downfall for the currency pair.

EUR/USD Technical Analysis

Euro/dollar is capped at around 1.2190, which is the confluence of last week’s high, and both the 100 and 200 Simple Moving Averages on the four-hour chart. While momentum remains to the upside, it is waning.

Above 1.2190, the next lines to watch are 1.2220, a high point early in the month, followed by 1.2270 and 1.2310.

Support awaits at the recent cushion of 1.2150, followed by 1.2125 – a former triple bottom – and then by 1.2080 and 1.2050.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750