- EUR/USD has been under pressure as markets sour on Biden’s suggestion of tax hikes.

- The Fed is set to keep its pressure on the dollar, and that is not fully priced in.

- Weak US data may also send the greenback down.

- Friday’s four-hour chart is showing that the downside break was fake.

“Buy the rumor, sell the fact” – President-elect Joe Biden’s economic plans were reported by the press well ahead of his speech and were already priced in by markets. Investors had already cheered the prospects of the $1.9 trillion stimulus package before he began speaking, and then retreated when he failed to top it up.

However, the picture could change again.

1) Rethinking Biden’s speech

The mood also soured when Biden said that “everyone must pay their fair share,” hinting at tax hikes. The fall in stocks sent traders to the safe-haven US dollar. This flight to the greenback seemed to have diminished when yields on US debt returned to dominate the currency. Risk on/risk-off is making a comeback of sorts.

Another concern is that Democrats will have a hard time passing all the measures, given their razor-thin majorities in both chambers of Congress – but that is not a novelty.

Overall, apart from the potential tax hikes – which may be shelved – there is little to scare investors. The market’s mood may improve once again.

2) Powell is powerful

Before Biden took the stage, Federal Reserve Chair Jerome Powell clarified that the bank is fully committed to the accommodative policy. He seemed to end speculation of early tapering of the Fed’s bond-buying scheme. The pledge to print dollars as long as necessary – and to keep rates at zero – only temporarily hit the greenback amid Biden’s speech.

Investors may have a rethink of Powell’s words, which put to rest the taper talk coming from his colleagues. Powell is the boss, after all.

3) Weak US data

The US economy needs all the stimulus it can get as it struggles with the fallout from the winter wave of coronavirus, coming on top of a lapse of several government programs. Jobless claims surged to 965,000, far worse than expected and the highest since the summer.

Friday’s publications are unlikely to be cheerful. The Retail Sales report for December will likely show a year-over-year gain in 2020, but a subdued Christmas shopping season. The University of Michigan’s initial read of Consumer Sentiment is also set to decline.

See

- US Retail Sales August Preview: Surprising facts on retail sales

- US Consumer Sentiment Preview: Expectations look rich, dollar could receive a (second) blow

These publications may push the dollar lower as investors price in lower-for-longer interest rates and Quantitative Easing.

What about the euro side of the equation? While Europe’s prospects leave much to be desired, the main driver is the dollar. France brought forward its nighttime curfew to 18:00 in most of the country Germany is mulling tightening its restrictions and so are Spain’s regions. In Italy, former Prime Minister Matteo Renzi triggered a coalition crisis.

Nevertheless, there is some room for recovery, coming from dollar weakness rather than euro strength.

EUR/USD Technical Analysis

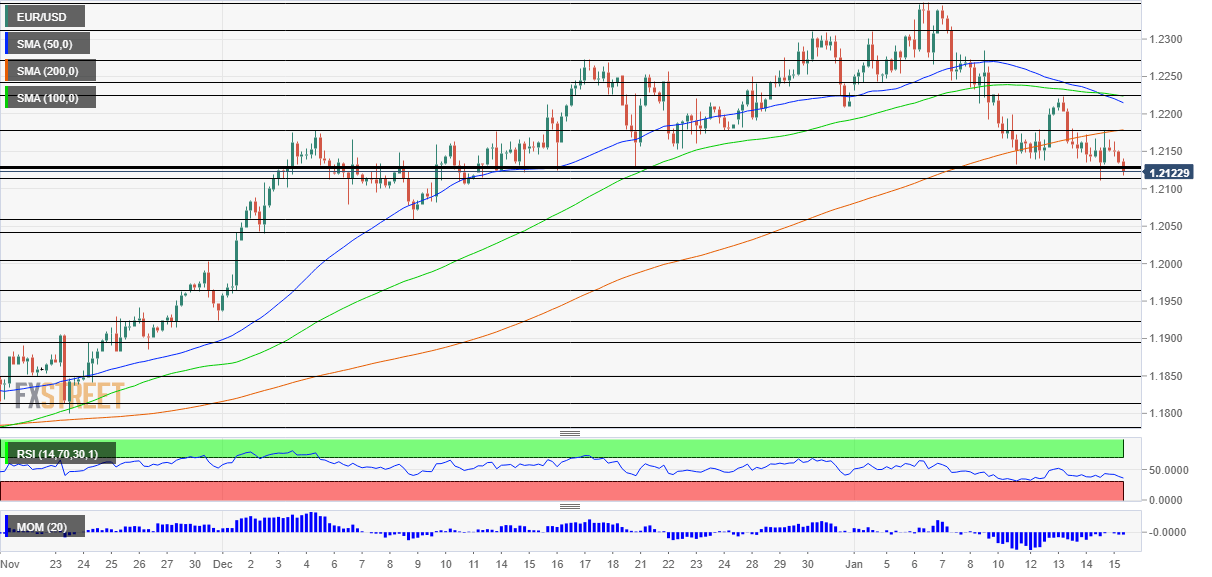

Euro/dollar dropped below the former triple bottom of 1.2125 on Thursday but recaptured that line. The new 2021 trough is 1.2110, and as long as that line holds, bulls have room to recover. Bears are still in the lead as momentum is marginal to the downside and the pair is trading below the 50, 100, and 200 Simple Moving Averages.

Below 1.21, the next lines to watch are 1.2060 and 1.2040.

Resistance awaits at Thursday’s peak of 1.2175, followed by 1.2222, the weekly high.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750