- EUR/USD has been holding onto high ground after the Fed pledged to support the economy.

- Weak US inflation and a reminder of the labor market’s struggles are set to weigh on the dollar.

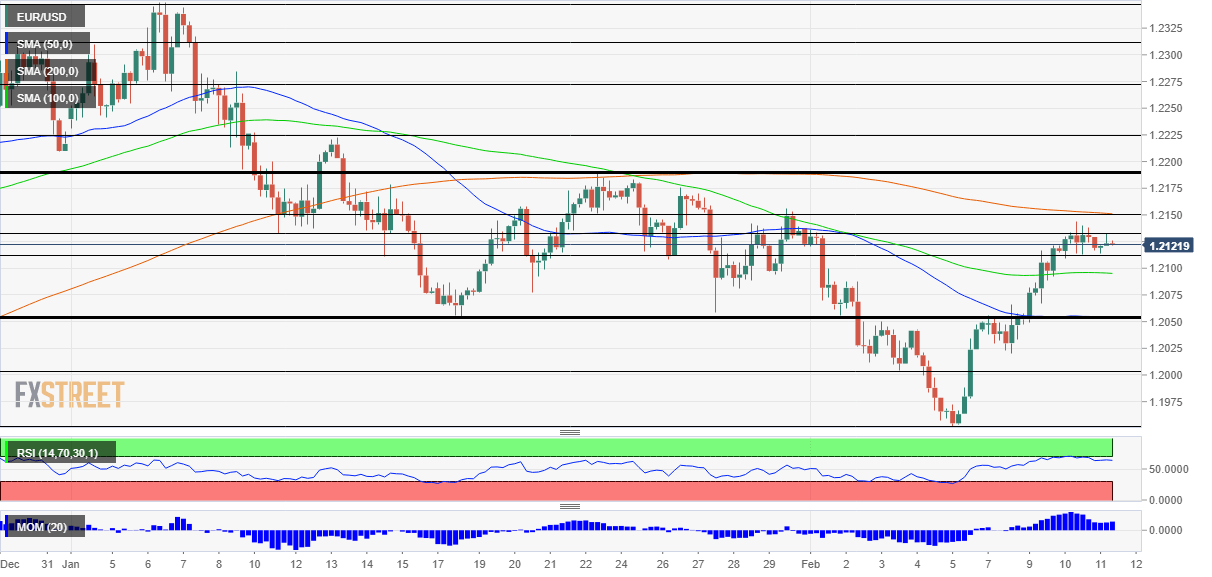

- Thursday’s four-hour chart is showing the currency pair has exited overbought territory.

Dead-cat bounce – a pattern that EUR/USD traders are familiar with, has its mirror image of consolidation before the next rise, and that may be in store for EUR/USD. The world’s most popular currency pair has been holding onto high ground and looks ready to further extend its gains.

Dollar weakness remains the main driver of the currency pair. Contrary to expectations of some market participants, America’s stimulus plans have yet to produce inflation as January’s Consumer Price Index figures have demonstrated – only 1.4% yearly in both headline and core gauges. That is well below the Federal Reserve’s 2% target.

These figures sent traders to buying bonds and the resulting lower yields made the dollar less attractive. While investors have responded to CPI, the words of Federal Reserve Chair Jerome Powell have not been fully digested. The powerful central banker stressed that any future inflation will likely “not mean that much” and moved to talk about the labor market.

Powell said that the US should strive to reach full employment, which is one of the Fed’s mandates. More importantly, he added that the bank will not automatically tighten policy solely on improvement in the job market. It does not get more dovish than that.

Overall, Powell signaled his full support to the economy and that should keep bond yields and the dollar depressed. Weekly jobless claims are due out on Thursday and are set to extend their decline. Will that help the greenback stabilize? Not so fast, as levels above 700,000 still reflect suffering in the world’s largest economy.

See US Initial Jobless Claims Preview: The trend’s the thing

Former President Donald Trump’s trial continues at full force in the Senate, consuming lawmakers’ energy. Investors are ignoring the political drama and await news related to President Joe Biden’s stimulus bill. Behind-scenes negotiations may eventually come to the open, but that may have to wait.

In the old continent, the debacle over vaccines remains high on the agenda, especially as Germany decided to extend its lockdown. Europe’s most ambitious countries have jabbed around 4% of their populations in comparison to roughly 10% in the US and 20% in the UK.

The slow exit from the covid crisis will likely result in sluggish economic forecasts from the European Commission, due out later in the day. Will all this gloom weigh on the common currency? Again, not so fast, as EUR/USD is mostly driven by the dollar.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart has dropped below 70 – exiting overbought conditions and allowing for more rises. The currency pair is trading between the 100 and 200 Simple Moving Average and momentum is positive.

Some resistance is at the daily high of 1.2130, followed by 1.2150, where the 200 SMA hits the price. Further above, the upside target is 1.2190, which was a stubborn cap in January.

Some support awaits at the daily low of 1.2115, followed by 1.2050, a clear separator of ranges. The next cushions are 1.20 and 1.1960.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750