- EUR/USD has been under pressure as US yields rise once again.

- Elevated expectations for US inflation figures may result in a disappointment, weighing on the dollar.

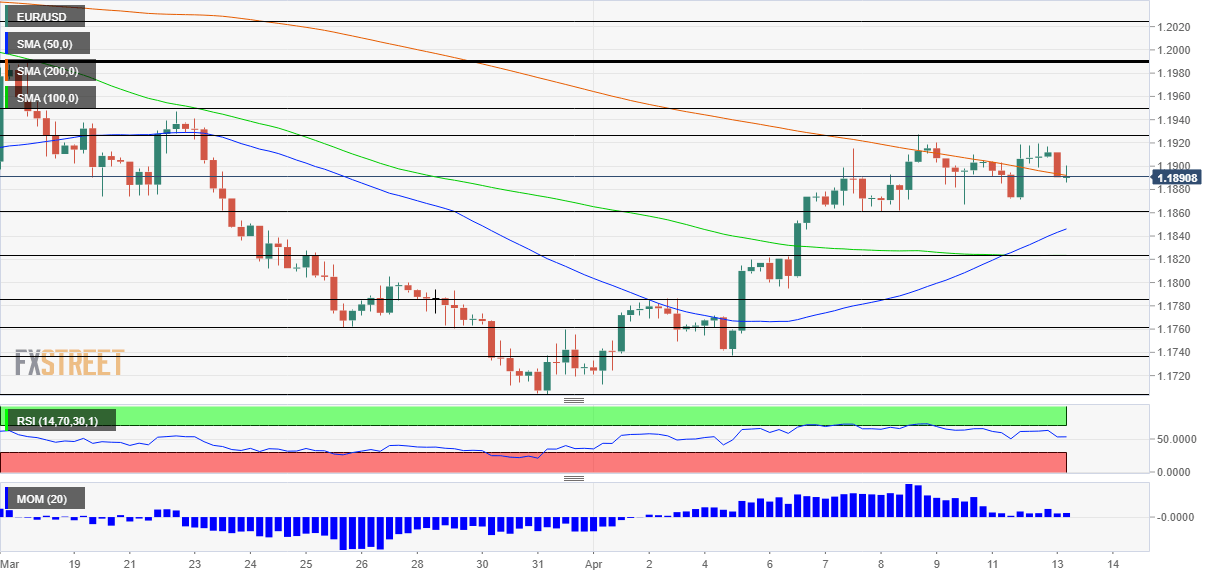

- Tuesday’s four-hour chart is pointing to an increase

When everybody is expecting an upside surprise, there is only one likely reaction – disappointment, and that may trigger price action. Investors are hyped up ahead of the release of US Consumer Price Index figures for March due out on Tuesday, awaiting inflation to lift its ugly head.

Year-on-year forecasts for CPI were already elevated as prices sharply dropped in March 2020 due to the pandemic’s outbreak, causing a “base-effect.” However, projections were further bumped up after producer prices showed a monthly leap of 1% last month. That implies that prices are already bubbling higher due to supply issues.

The US dollar is already on the rise ahead of the release, rising alongside bond yields. However, this sell-off of bonds comes despite a successful ten-year Treasury bond auction on Monday. Federal Reserve officials have been maintaining their calm tone – waiting to acknowledge price rises only if they are sustained.

With healthy demand for US debt and calming messages from the Fed, it seems that the upside driver for the greenback is only expectations for the upcoming CPI release. On this background, a “buy the rumor, sell the fact” response in the dollar is a plausible outcome. For EUR/USD, it means further upside potential.

US Inflation Cheat Sheet: Dollar selling opportunity? Three scenarios for the critical event

An increase in the euro’s value would come despite ongoing issues in Europe. German Chancellor Angela Merkel’s CDU/CSU political bloc is split on who would lead the party in September’s general elections as the “locomotive” of the old continent continues grappling with COVID-19.

On the other hand, hopes for an accelerated vaccination campaign and potentially robust estimates from the German ZEW Economic Sentiment statistics for April may keep the common currency bid.

All in all, there is room for EUR/USD to rise, driven mostly by a turn-down in the dollar.

EUR/USD Technical Analysis

Euro/dollar has been trading in a range, as the four-hour chart shows. Momentum is marginal to the upside and the currency pair trades just above the 200 Simple Moving Average. The 50 SMA has crossed above the 100 SMA, a bullish sign.

Resistance awaits at April’s peak of 1.1920, followed by 1.1950, which was a high point in late March. Further above, 1.1990 and 1.2020 are watched.

Support is at 1.1860, the bottom of the current range, followed by 1.1820 and 1.1780, both stepping stones on the way up.

More Dollar rally coming? Clarida’s clarity, powerful PPI, point to the Fed raising rates sooner