- EUR/USD has hit the highest levels since 2018 as US Democrats are heading toward Senate control.

- Vaccine news, US data and the Federal Reserve’s minutes may provide room for further gains.

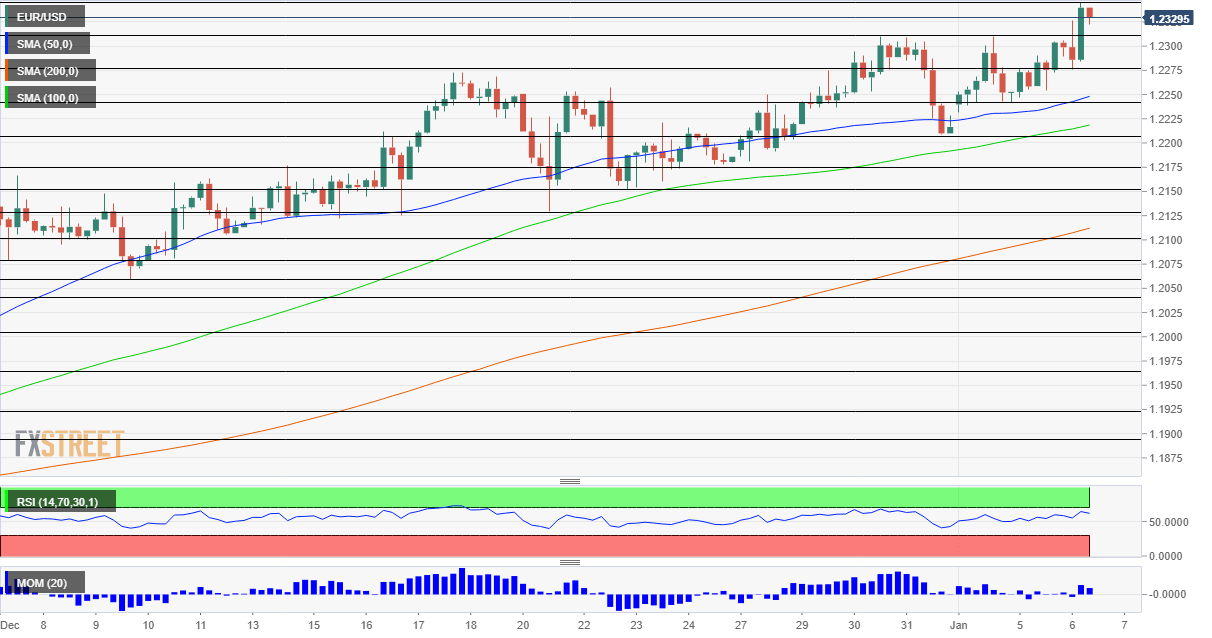

- Wednesday’s four-hour chart is painting a bullish picture.

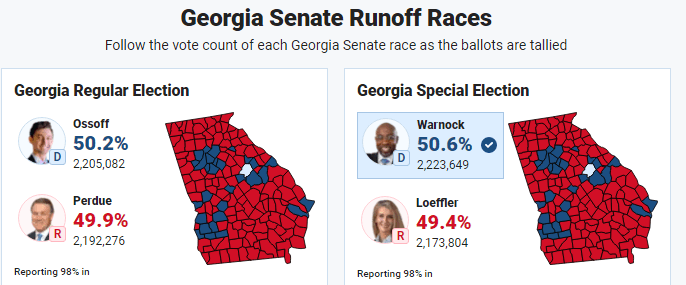

Surfers go out to sea also in winter – and EUR/USD is catching the blue wave to ride to fresh highs near 1.2350. The safe-haven US dollar is sold off as Democrats are on course to secure control of the Senate after most votes have been counted in Georgia. That would enable President-elect Joe Biden to pass more stimulus, while the razor-thin majority – 51 to 50 thanks to Vice-President-elect Kamala Harris’ tie-breaking authority – is insufficient for market unfriendly reforms.

At the time of writing, networks called Democrat Rapahel Warnock the winner against Republican Kelly Loeffler. In the second race, GOP Senator David Perdue is trailing Democrat Jon Ossof by only 0.29% but the remaining votes are from Democratic-leaning counties. Additional results are due out later in the day.

The flight away from the safety of the greenback is a repeat of a familiar move. On the other hand, the dollar’s retreat is somewhat limited by the rise in US Treasury yields –the ten-year return surpassed 1%, making the world’s reserve currency more attractive. Prospects of additional government spending mean higher bond issuance.

Georgia Elections Analysis: Markets to surf higher on imminent blue wave, USD to chop around

Source: Fox News

Will the Federal Reserve step in and purchase more government debt? That could depress yields and cement the dollar’s downfall. Clues about Fed policy are due later in the day when minutes from its December meeting are released. Back then,

Fed Chairman Jerome Powell provided guidance about the bond-buying scheme and pledged to do more if necessary. The protocols may provide clues about how close the bank is to expanding its scheme, now standing at around $120 billion/month.

More Five factors moving the US dollar in 2021 and not necessarily to the downside

Earlier, ADP’s labor statistics for December are forecast to show a slowdown in private-sector hiring after a healthy increase of 307,000 positions in December. While the payroll firm’s figures often fail to correlate with official data, the release tends to move markets. The ISM Manufacturing Purchasing Managers’ Index beat estimates with 60.7 points and signaled increased hiring in the services sector.

Coronavirus cases and deaths continue rising across the northern hemisphere. The US reported nearly 4,000 mortalities on Monday and Germany extended its nationwide lockdown through the end of January. Moreover, British scientists are worried that the South African strain is resistant to vaccines.

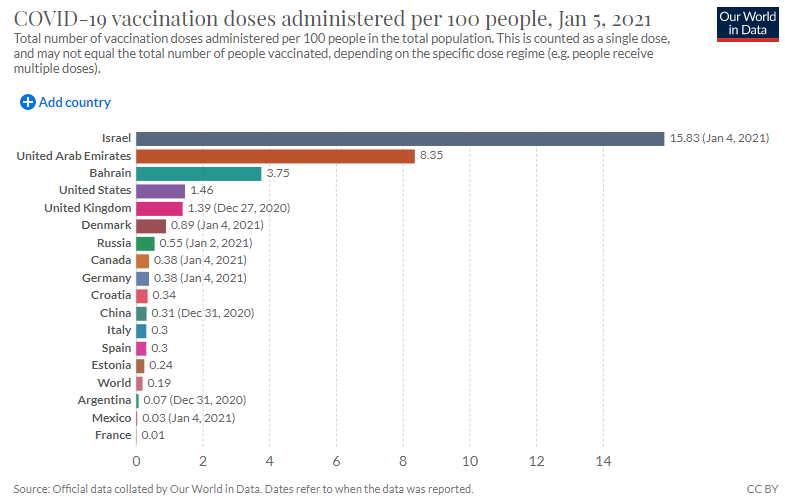

On the immunization front, the European Medicines Agency is set to approve Moderan’s jab on Wednesday. At the moment, the bottleneck is in distributing the inoculation rather than at the regulatory level. Policymakers on both sides of the pond are under pressure to ramp their vaccination campaigns, following Israel’s example.

America vaccinated only around 1.5% of its population, Germany 0.4%, while Israel topped 15%.

Source: OurWorldInData

More Coronavirus: Statistics, herd immunity, vaccine calendar and impact on financial markets and currencies

Final Services PMIs in Europe confirmed that the sector – hit by COVID-19 – continues contracting. France’s preliminary Consumer Price Index Index read came out at 0.2%, worse than expected.

Overall, while the dollar may benefit from rising yields, the Fed´s commitment to act, vaccine hopes, and perhaps poor data may push the currency pair higher.

EUR/USD Technical Analysis

The recent surge has placed momentum on the four-hour chart on positive ground while the Relative Strength Index is below 70 – outside overbought conditions. This Goldilocks scenario is bullish for euro/dollar, which also trades well above the 50, 100, and 200 Simple Moving Averages.

The fresh 2021 high of 1.2345 is the initial resistance level. It is followed by 1.24, a cap back in 2018, and finally by 1.2555, the peak back then.

Support awaits at 1.2310, the former double top, followed by 1.2275, a high point in mid-December. Further down, 1.2240 and 1.2210 await EUR/USD.

More EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750