- EUR/USD has been struggling around 1.2050 as higher US yields support the dollar.

- Fed Chair Powell holds the keys for the next moves in a critical speech.

- US stimulus and jobless claims are also set to move markets ahead of Friday’s jobs report.

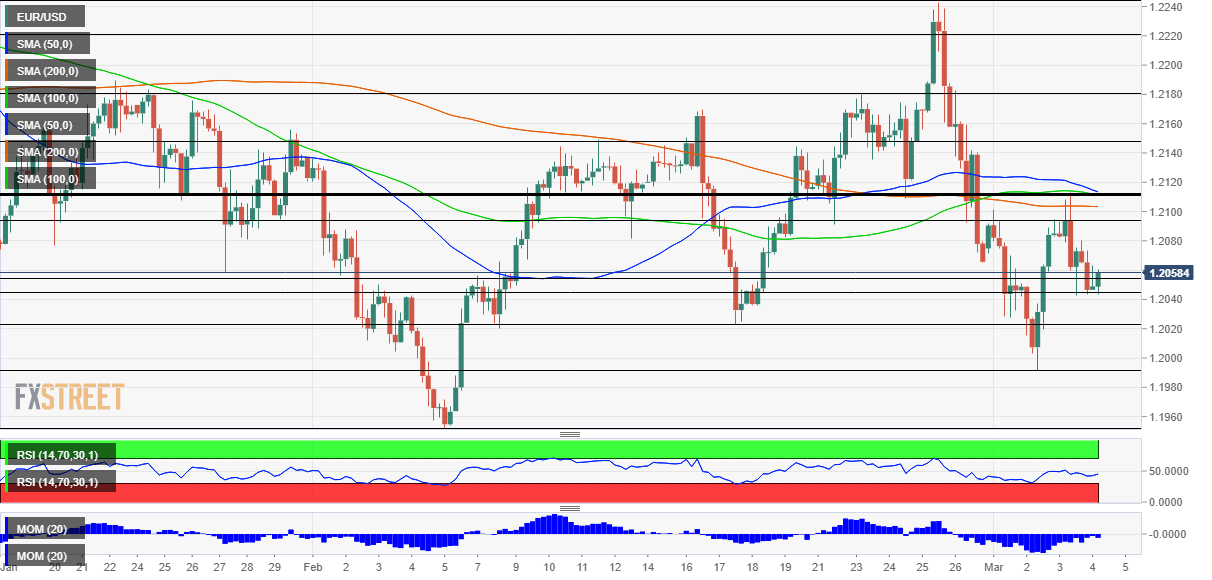

- Thursday’s four-hour chart is showing bears remain in the lead.

Rejected at resistance – but there is still one more hope left for EUR/USD bulls, coming from Jerome Powell, Chair of the Federal Reserve. Will he send the dollar down?

The main upside driver of the US dollar has been the rise in Treasury yields – with returns on ten-year Treasuries remaining too close to the 1.50% level. The world’s most powerful central banker speaks at 17:05 in his last appearance before the Fed’s “blackout period” ahead of the mid-March rate decision, and may potentially hint the Fed is ready to act to bring returns down.

So far, Powell has seen the rise in yields as reflecting upbeat growth prospects and allowing the dollar to rise. He also shrugged inflation concerns, labeling them as transitory and foreseeing higher price rises only within three years – far from market expectations. His colleagues made similar comments, apart from one. Governor Lael Brainard said that the move “caught her eye” – a subtle hint that the bank is somewhat uncomfortable with the increase in long-term borrowing costs.

What will Powell say? There are three paths he can take, from repeating previous comments, through echoing Brainard, and finally saying the Fed is ready to intervene, similar to what European Central Bank members have been saying.

See Powell Preview: Three scenarios for the Fed to defuse the bond bonfire, market implications

Elevated US yields come as President Joe Biden accepted a compromise on stimulus checks – potentially paving the way for approving his covid relief package in the Senate. A vote in the upper chamber may come as soon as Thursday. Lower cutoff limits for these $1,400 payments are unlikely to be a dealbreaker for progressive Democrats in the House.

On the other hand, bonds seem to have shrugged off a duo of disappointing US figures. ADP’s private-sector employment statistics showed an increase of only 117,000 positions, worse than expected. The ISM Services Purchasing Managers’ Index fell short of estimates both on the headline and also on the employment component – critical for Friday’s Nonfarm Payrolls report.

Powell and his peers stressed that ten million Americans are out of work, and that guides their policy – not higher inflation expectations. Weekly jobless claims are due out on Thursday.

See US Initial Jobless Claims Preview: On the verge of an explosive recovery?

In the old continent, Germany is set to ease some restrictions on Monday but extend most measures through late in March. European countries are looseing their limits on using AstraZeneca’s COVID-19 vaccines after a low takeup. The US already inoculated around 16% of its population while European countries are far from reaching double-digits.

All in all, vaccination and growth prospects point to further falls, but if Powell hints the Fed is ready to act, EUR/USD could jump.

EUR/USD Technical Analysis

Euro/dollar continues suffering from downside momentum on the four-hour chart and trades below the 50, 100 and 200 Simple Moving Averages, which are converging around 1.2110 – a critical resistance line.

Above 1.2110, the next levels to watch are 1.2150, 1.2180 and 1.22.

Some support awaits at the daily low of 1.2040, followed by 1.2020, a cushion from mid-February, and then by 1.1990 and 1.1950.

Where next for the dollar as the Fed refocuses, bonds bring action, jobs set to cause jitters