- EUR/USD has been rising after Fed Chair Powell cheered investors by pledging support.

- Higher yields on Treasuries support the dollar, but US data could disappoint and push it lower.

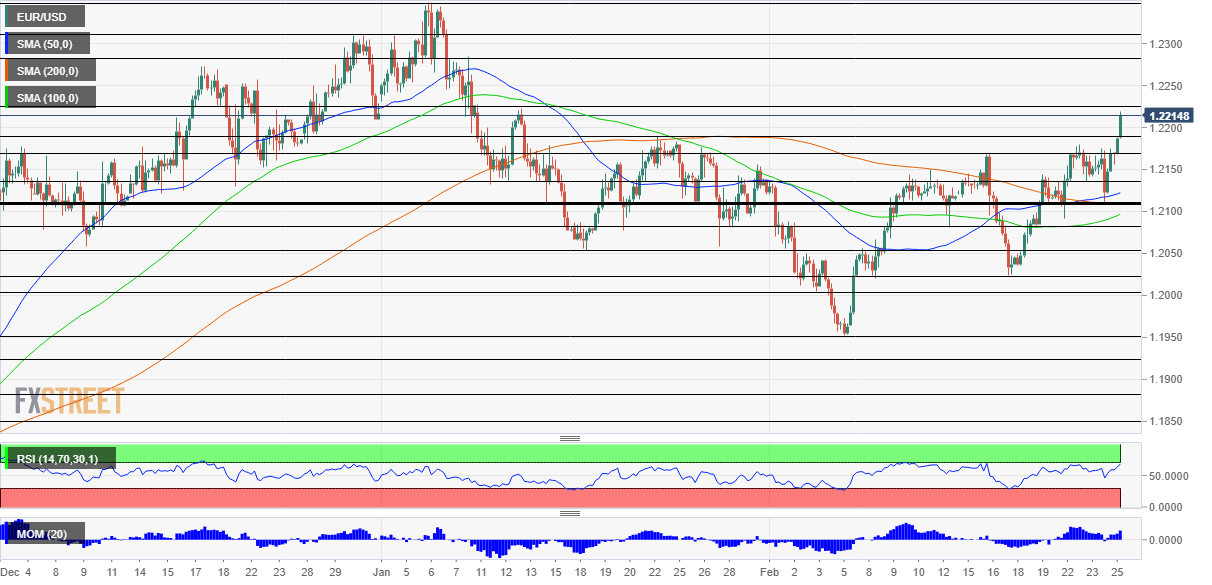

- Thursday’s four-hour chart is showing bulls are in control.

We will believe it when we see it – that sums up the message on inflation from Jerome Powell, Chairman of the Federal Reserve, and his colleagues in recent days. The world’s most powerful central banker is unimpressed from rising inflation expectations and only hopes to reach the Fed’s 2% goal within three years. His downplaying of expectations for higher prices imply the bank will keep rates near zero and print dollars at a fast clip going forward. And that is negative for the greenback.

Apart from inflation, the other Fed mandate reaching full employment, and also, in this case, it is waiting to reach such levels before acting. Moreover, the bank is more focused on bringing the ten million Americans that lost their jobs in the pandemic back – and not watching the jobless rate.

The Fed’s commitment to keeping rates low has boosted sentiment and that is also weighing on the dollar, despite the rise in US yields. Returns on ten-year Treasuries have hit 1.44%, a one-year high – yet the dollar fails to gain ground.

Will yields trigger a greenback comeback? Perhaps, but it would battle the risk-on mood – handing the power of breaking the tie to a big bulk of US data. As the economic calendar is showing, expectations are upbeat for all figures – leaving room for disappointment.

Economists expect the second release of Gross Domestic Product to show an upgrade to fourth-quarter growth from 4% to 4.1% annualized. The more recent Durable Goods Orders statistics for January are set to continue rising, and even accelerate, reflecting robust investment.

Weekly jobless claims data for the week ending February 22 are also predicted to improve and drop from the highs of 838,000. Are all these estimates too high? That would push the dollar down.

See

- US January Durable Goods and Q4 GDP Preview: Consumers worry but they spend

- US Initial Jobless Claims Preview: Exceptional layoffs become mundane

What about developments in Europe? investors seem to have already priced in a delay in AstraZeneca’s delivery of vaccines to the EU and focus on the upbeat sentiment. EU leaders hold a conference on Thursday and are unlikely to touch on any economic figures, but rather discuss green passports.

All in all, there is room for more dollar falls.

EUR/USD Technical Analysis

Euro/dollar has broken above the mid-January high of 1.2250 and also continues benefiting from upside momentum on the four-hour chart. Moreover, it is trading well above the 50, 100 and 200 Simple Moving Averages, while the Relative Strength Index is below 70 – outside overbought conditions.

Resistance awaits at 1.225, which was a peak in mid-January. It is followed by 1.2280, a swing high early in the year, ahead of 1.2310 and 1.2350.

Support awaits at the 1.2190 level mentioned earlier, followed by 1.2170 and 1.2130.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750