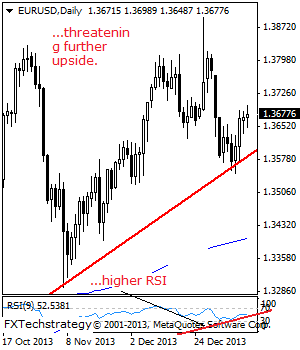

EUR/USD: With a second day of recovery occurring on Monday, there is risk of further price extension. This development could force the pair to recapture the 1.3700 level where a violation will mean further upside pressure towards its Jan 02 2014 high at 1.3766 level.

Further out, resistance comes in at the 1.3818 level, representing its Dec 30 2013 high. A turn above here will pave the way for the pair to push further higher towards its Dec2013 high at the 1.3893 level. Its daily RSI is bullish and pointing higher supporting this view.

On the other hand, support comes in at the 1.3571 level where a break will turn attention to the 1.3548 level. We expect a cap to occur here and turn the pair back up but if taken out expect more decline towards the 1.3500 level. We may see the bulls come in here and push the pair higher.

All in all, EUR continues to retain its upside bias in the medium term but faces corrective weakness

Guest post by FX Tech Strategy