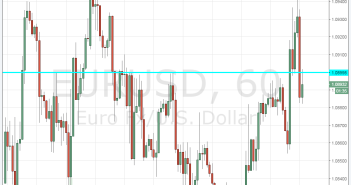

EUR/USD is ticking higher within range but still looking for a direction. News concerning the ECB has triggered ups and downs. On one hand, a Reuters article basically said the door is closed on more moves, while the minutes showed an option to hike. Is the result in the middle?

Not exactly.

A lot depends on inflation: so far, so bad, with yet another fall even before the recent slide in oil, but it may not be enough. The bar may be higher as opposition is mounting and also governments are requested to do more, and more than ever.

The ECB convenes next week and nobody expects action. However, there could still be action in March, yet as aforementioned, it would be a tough task.

But even if the ECB stories put EUR/USD at a balanced position, the bad news help it, as the safe haven status persists. And this is relevant even if the problems come from within the euro-zone.

Volkswagen is not alone: Shares of French carmaker Renault plunged on allegations of fraud. Nobody thought that the car industry was full of angels and that VW was the only sinner. And today when the news about Renault broke out, it also adds to worries about growth, in France, Europe and the world, and this causes more repatriation.

And in general, it seems that markets are looking for bad news to sell stocks.

US figures currently do not make a difference:Â US jobless claims came out at 284K, worse than 275K expected and above the range for the second time in the past weeks. On the other hand, import prices dropped by 1.2%, better than 1.4% expected.

So all in all, within the current range trading of EUR/USD, there is more upside than downside risk. This could change, but the current trend looks marginally positive.