- EUR/USD may find it hard to recover if US fiscal stimulus is derailed.

- End-of-year flows, Brexit and data are in play ahead of Christmas.

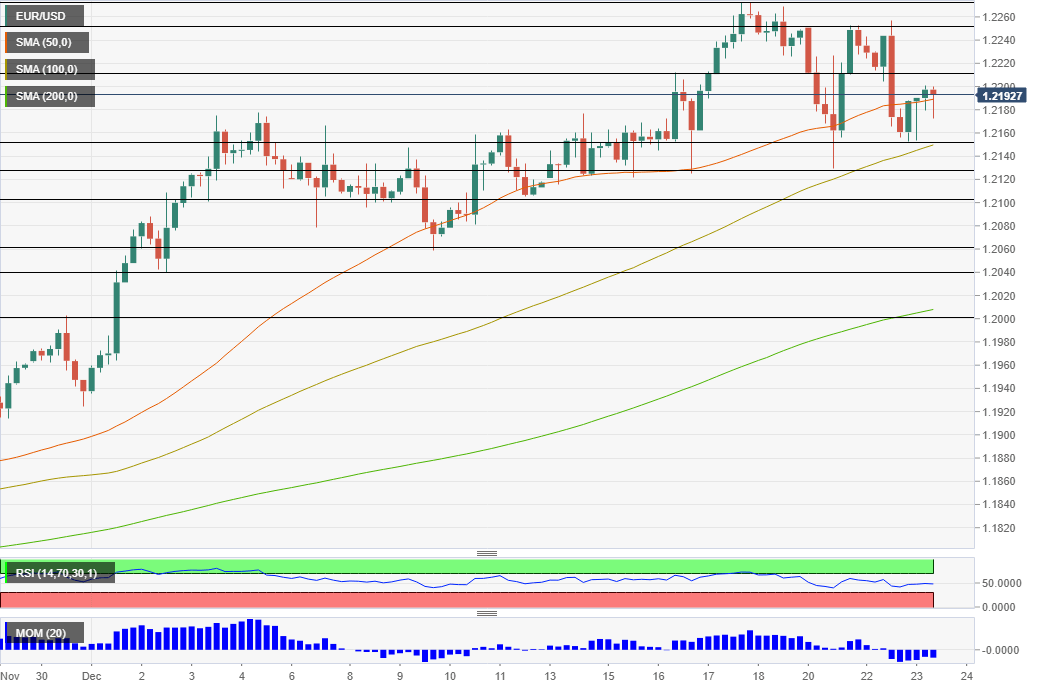

- Wednesday’s four-hour chart is showing bears are gaining ground.

“A disgrace” – Outgoing President Donald Trump’s words on the stimulus bill he had urged Congress to pass cause confusion in markets. The Commander-in-Chief wants Americans to receive checks worth $2,000 instead of $600 raise fears he will not sign the legislation into law ahead of Christmas.

House Democrats – who crafted the relief package with Senate Republicans – seem to support higher payments, putting the GOP in a bind. If Trump vetos the bill, the bipartisan majority would override it and turn it into law. However, Trump could just hold the package hostage – not signing it nor vetoing it. That would cause a government shutdown early next week.

So far, investors are trying to digest Trump’s defiant message with one month to go until he leaves the White House. The president continues to deny he lost the elections. EUR/USD dropped before the political bombshell in what seems to be profit-taking ahead of the festive season.

Wednesday is the last full day before the holidays, and additional jitters are likely. While American politics could still drag it down, tensions between Paris and London have eased France is partially opening its sea border with the UK after the sudden shuttering on Sunday amid fears of the covid strain.

Truck drivers will have to undergo rapid coronavirus tests and the enormous traffic jams are set to unwind. Scientists remain confident that the new variant is not vaccine-resistant – and that it is already circulating in the continent anyway.

The diffusion of tensions may also contribute to a Brexit deal – as the EU and the UK are getting closer on fisheries.

Apart from politics, a busy data day awaits traders. US jobless claims have likely remained elevated while Personal Income and Personal Spending probably dropped in November. On the other hand, Durable Goods Orders, which represent investment, may have advanced last month.

See

- US Personal Income Preview: Dollar may decline on the reminder of dire straits yet timing matters

- Durable Goods Orders Preview: Long-term investment likely got a shot in the arm, dollar-positive

All in all, Trump’s move overshadows positive developments for euro/dollar – and end-of-year moves may wreak havoc too.

EUR/USD Technical Analysis

Euro/dollar is struggling to hold onto the 50 Simple Moving Average and is suffering from downside momentum On the other hand, the currency pair trades above the 100 and 200 SMAs.

Some resistance awaits at 1.22, the daily high, followed by 1.2250 and then by the 2020 peak of 1.2272.

Support awaits at 1.2150, the daily low, followed by 1.2130 and 1.21.