EUR/USD was hit hard on the British decision to leave the EU. This was certainly not priced in and many questions are left open. Will we see more falls? Apart from the Brexit fallout, we have elections in Spain,, inflation figures and more PMIs.  Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Contrary to the latest polls, Brits decided to leave the EU in a decisive 52% to 48% vote. The Brexit has implications not only on the UK economy and the collapsing pound, but also the euro-zone economies and the fate of the European Union. There are many uncertainties and scrambling continues. An economic slowdown or even a recession cannot be ruled out. Will the ECB provide more stimulus? President Draghi left the door open to the this before the referendum and we may hear more as events develop. Elsewhere, the German economy looks good with beats in the ZEW and IFO business sentiment measures. In the US, Yellen sounded quite dovish and figures were mixed, but the greenback enjoyed safe haven flows, second only to the yen.

Updates:

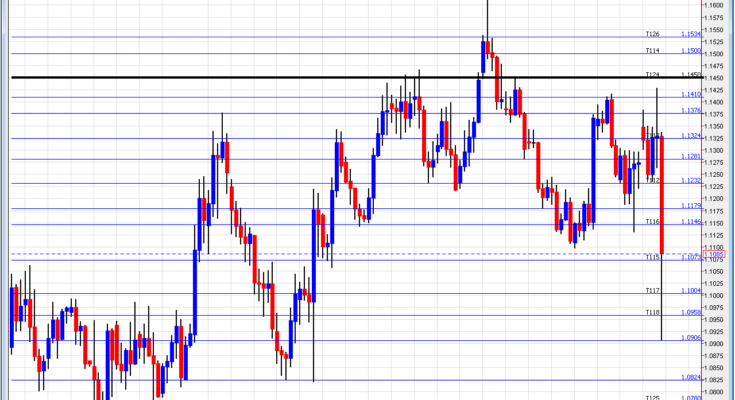

EUR/USD daily chart with support and resistance lines on it. Click to enlarge: