- EUR/USD has been on the back foot as the market mood sours.

- The ECB’s fiercer words against the euro are weighing on the common currency.

- A row over vaccines is set to delay the eurozone’s recovery.

- US data may fuel the risk-off sentiment,

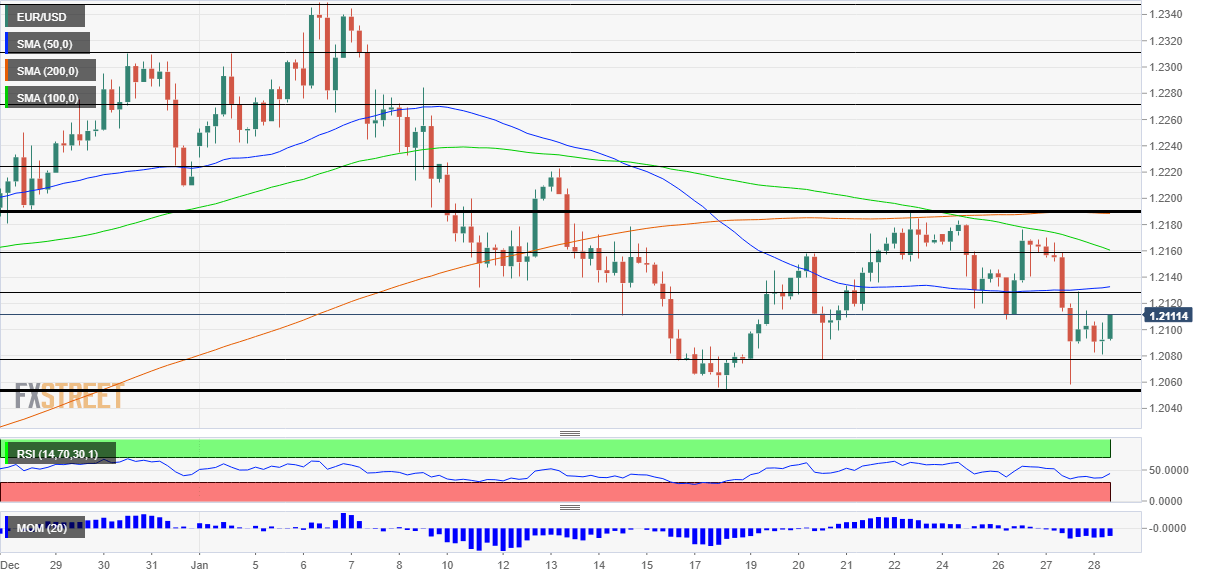

- Thursday’s four-hour chart is painting a bearish picture.

Light at the end of the tunnel? That may be a truck coming at full speed to ram EUR/USD bulls. The recent falls may be the beginning of a more significant downfall, which could send the pair to fresh 2021 lows.

Here are five reasons for an extended downfall:

1) Market gloom

The madness around Gamestop – where retail traders are pushing the valuation of a videogame firm and defeating hedge funds – may be a sign of market exuberance – and a late-stagy rally. While several shares such as GME are skyrocketing, the bigger ones are on the back foot in fear of a sell-off.

When shares fall, the safe-haven dollar gains, weighing on EUR/USD. The Federal Reserve did its best to cheer investors by committing to support the economy as much as needed and refusing to see the recent equity frenzy as “froth.” Moreover, Fed Chair Jerome Powell said that it is premature to talk about an exit and that the economy has a long way to go. His words imply lower rates and elevated bond-buying for longer.

If the world’s most powerful central bank is unable to turn the market mood – at least for now – there is more room for risk aversion.

See:

- Federal Reserve Holds Policy Steady; Vaccine crucial to recovery

- Fed Quick Analysis: Powell refuses to stop the stock party, dollar may suffer some pressure

2) ECB becoming tough

On the other side of the pond, European Central Bank member Klaas Knot explicitly complained about the high valuation of the euro, adding that his institution has tools to deal with it. Later on, reports suggested that the ECB may further cut its deposit rate – which is at -0.50%. The specter of more cuts is weighing on the euro.

During 2020, the ECB expanded its balance sheet, but the euro advanced instead of falling.

3) AstraZeneca-EU row

Some Spanish regions are already running out of vaccine dose. What began as a delay from Pfizer/BioNTech was compounded by a delay of jabs from AstraZeneca and now aims to derail the recovery.

Brussels and the British pharmaceutical firm are feeding about the timing of doses’ deliveries, with the bloc suggesting it could go to courts. The European Medicines Agency is set to approve AstraZeneca’s immunization on Friday.

4) US Data may be depressing

Economists expect America’s economy to have grown by 3.9% annualized in the fourth quarter of 2020 – but it could be lower. Durable Goods Orders figures for December mostly missed estimates and Retail Sales dropped in both November and December, the holiday season.

See: US Fourth Quarter GDP Preview: Variety is the spice of markets

Weekly jobless claims also carry expectations for improvement – yet from worrying levels as well. Applications are set to drop from 900,000, and if they remain too high, another month of job losses is likely in the US.

See US Initial Jobless Claims Preview: California returns to work

Weak figures are set to further depress markets, boosting the safe-haven dollar instead of weighing on it.

5) Technicals point down

Euro/dollar has decisively dropped below the 50 and 100 Simple Moving Average on the four-hour chart and is suffering from downside momentum. Moreover, the Relative Strength Index is still above 30 – outside oversold conditions.

Bears are eyeing 1.2080, the daily low, as their first target. Critical support is at 1.2060, Wednesday’s swing low and just above the 2021 trough of 1.2055. This near-perfect double-bottom is critical support. The next level to watch is 1.20.

Looking up, some resistance awaits at 1.2130, which is where the 50 SMA hits the price, followed by 1.2160 and then by 1.2190 – the latter being a strong cap.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750