- EUR/USD has been advancing amid upbeat PMIs and despite a souring market mood.

- Markets are digesting the ECB’s decision and awaiting Biden’s speech on the economy.

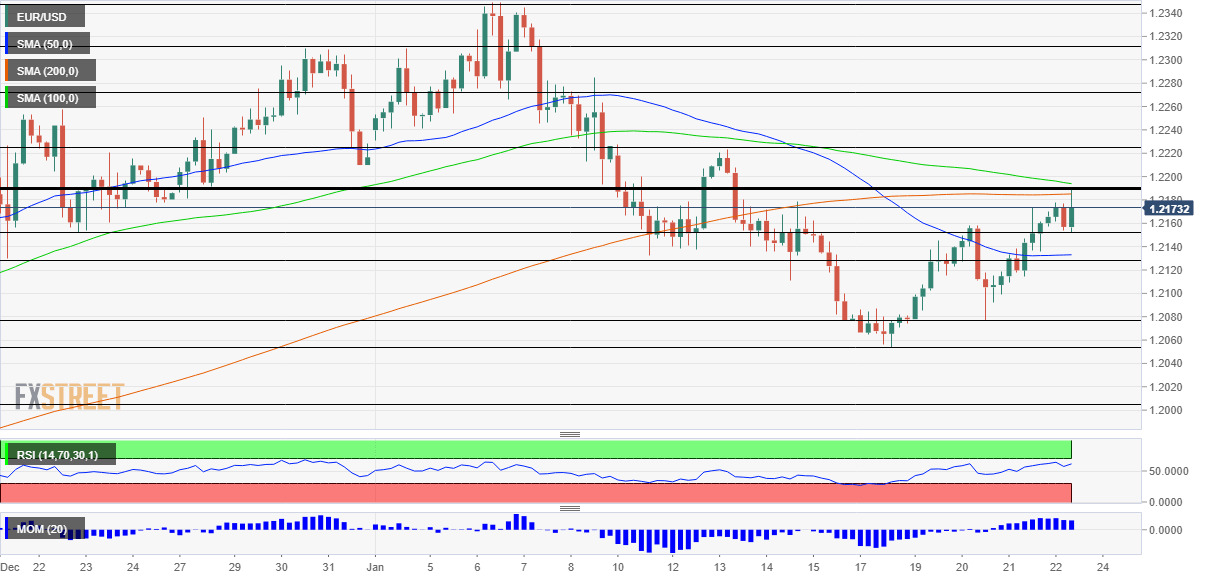

- Friday’s four-hour chart is showing that the pair is nearing critical resistance.

When a currency holds its ground despite adverse news – it is showing its strength and may have room to rise when the tide turns. One reason to advance is Markit’s relatively upbeat Purchasing Managers’ Indexes figures for January, but they only marginally exceeded estimates. Moreover, the services sector is still contracting, reflecting the pain of the lockdowns.

The safe-haven dollar is gaining ground across the board as investors are worried about the chances that President Joe Biden’s $1.9 trillion stimulus proposal fails to gain traction. Senate Republicans – ten of whom are needed for a swift passage of the bill – have their reservations. The final deal could be smaller or just be dragged. Biden will deliver a speech on the economy at 19:45 GMT and the media may provide details earlier,

Euro/dollar has hit the highest in the week, also defying frustration about Europe’s slow vaccination pace and potential for extended lockdowns. European governments are considering slapping stricter border controls and banning non-essential travel.

Perhaps one the factors underpinning the common currency is the European Central Bank’s decision. The Frankfurt-based institution said that risks remain tilted to the downside, but that they are “less pronounced.” While ECB President Christine Lagarde also emphasized the need for monetary support – and the policy remained unchanged – the marginally more upbeat sentiment may be boosting sentiment.

More ECB Analysis: Three ways Lagarde is leveling up EUR/USD

Can EUR/USD continue higher? Coronavirus statistics from across the continent and speculation about Biden’s speech are in the spotlight.

EUR/USD Technical Analysis

Momentum on the four-hour chart remains to the upside and euro/dollar is trending higher. After surpassing the 50 Simple Moving Averages, it is now battling the convergence of the 100 and 200 SMAs around 1.2190 – which is the daily high.

If EUR/USD breaks this critical resistance line, the next hurdle is 1.2220, which was a high point last week. Further above, 1.2275 and 1.2310 are eyd.

Some support is at the daily low around 1.2150, followed by 1.2130 and 1.2080.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750