- EUR/USD has been under growing pressure as Fed reluctance to tackle yields boosts the dollar.

- ECB efforts to curb rises in long-term returns on Europe’s covid struggles weigh on the euro.

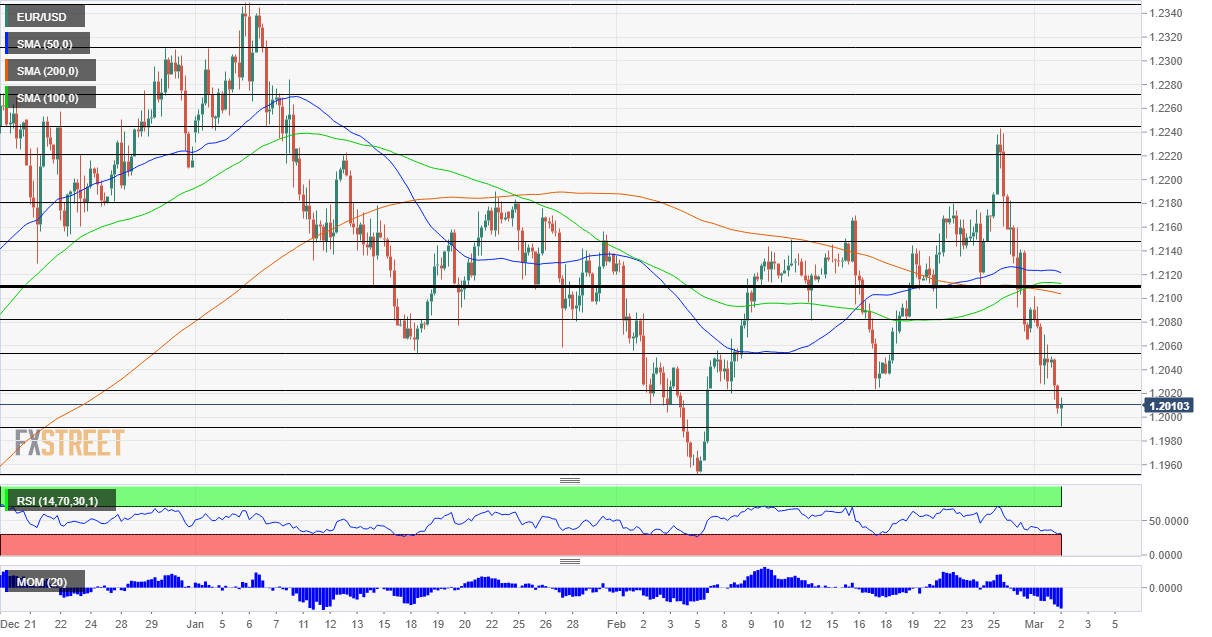

- Tuesday’s four-hour chart is pointing to further falls, with only a limited room for a bounce.

Are higher yields good or bad? The response depends on which central bank answers the question – and that is what makes the difference for EUR/USD.

The Federal Reserve sees the increase in returns on long-term US debt as a sign of stronger growth prospects. According to Thomas Barkin, President of the Richmond branch of the Fed, the greater worry for the world’s most powerful central bank is that ten million Americans are out of work.

His words echo those of his colleagues. Later in the day, Fed Governor Lael Brainard will be speaking, and investors are already eyeing Chair Jerome Powell’s speech on Thursday – his last appearance before the bank’s rate decision later this month.

See Powell Preview: Three scenarios for the Fed to defuse the bond bonfire, market implications

On the other side of the pond, the European Central Bank is increasingly worried about the increase in yields on sovereign bonds in the old continent. ECB Vice-President Luis de Guindos is the latest to say that the Frankfurt-based institution is ready to act if the sell-off hurts financial conditions.

If returns on US debt are higher than those in Europe, there is room for more EUR/USD declines.

Moreover, the economic situation is different on both sides of the pond. The US ISM Manufacturing Purchasing Managers’ Index smashed estimates with an increase to 60.8 in February. Notable gains were seen in the inflation component and in the employment one – the latter signaling at a robust Nonfarm Payrolls report on Friday.

That comes before the Senate discusses President Joe Biden’s covid relief package worth $1.9 trillion. The upper chamber will likely water down some of the elements in the program, but still, provide robust stimulus.

In the meantime, Germany is set to extend lockdown measures through March 28 and France is also considering new restrictions. While the vaccination pace has increased in Europe and tops 5%, it lags behind the US, which has vaccinated 15% and is moving rapidly.

All in all, there is room for more declines.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart is nearing 30 – close to entering oversold territory. That implies a temporary rise is on the cards – a dead-cat bounce. In the bigger scheme of things, there is more room to the downside as momentum leans lower and the pair crashed below the 50, 100 and 200 Simple Moving Averages.

Support awaits at the daily low of 1.1990, followed by the 2021 trough of 1.1950. Further down, 1.1930 and 1.1880 await the currency pair.

Resistance is at 1.2020, a swing low which was seen in mid-February, followed by 1.2055 and 1.2080.

Five factors moving the US dollar in 2021 and not necessarily to the downside