- EUR/USD has been failing to take advantage of the upbeat market mood and advance.

- Concerns about eurozone growth, vaccine supplies or US stimulus may spark a sell-off.

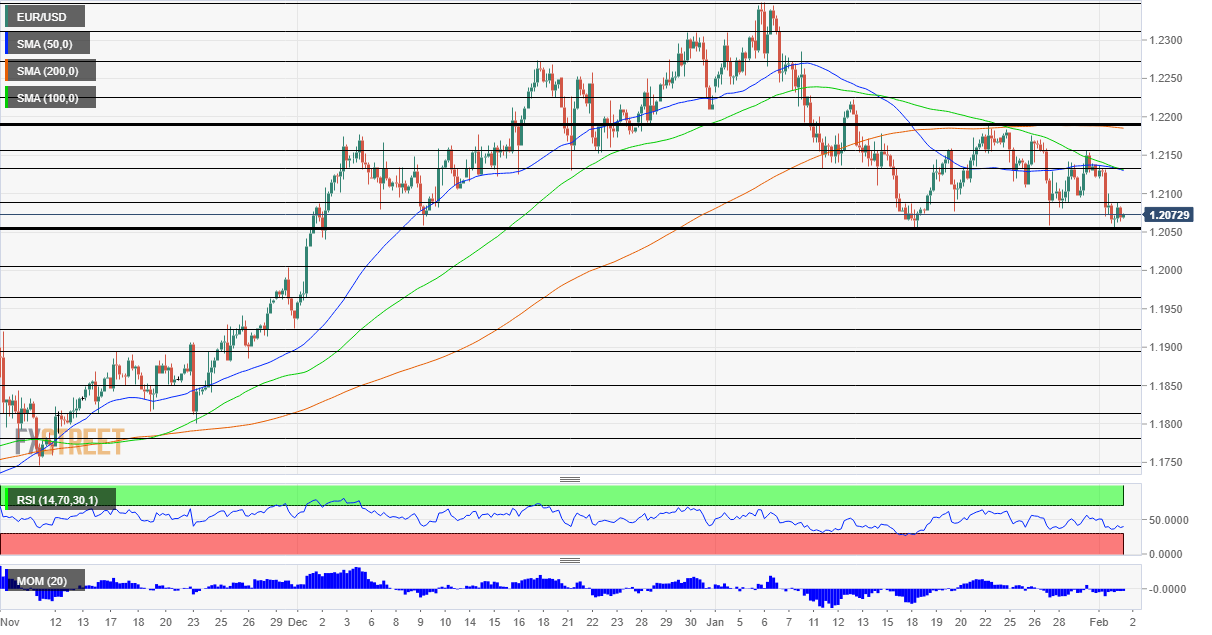

- Tuesday’s four-hour chart is pointing to further losses.

Another day, another EUR/USD dead-cat bounce – but this one may lead to a loss of critical support. The euro is unable to take advantage of the dollar’s weakness, and that could be a sign of things to come.

Why is the greenback giving ground?

Investors are selling the safe-haven dollar amid fresh optimism on several fronts. US President Joe Biden has met a group of ten Republican senators who laid down a stimulus proposal worth around $600 billion – less than a third of the White House’s $1.9 trillion plan. Both sides described the meeting as productive, a positive development.

With the support of ten GOP members, Biden would have the backing of 60 senators – a filibuster busting majority that would enable sending funds swiftly to the economy. Will markets see $600 billion as insufficient? Perhaps, and Democrats may still decide to go it alone without Republican support, using a process called “reconciliation.” Nevertheless, markets are happy with prospects of progress.

Another reason to be cheerful is America’s rapid vaccination campaign – which has picked up speed in recent days – and compounds a decline in COVID-19 cases and especially hospitalizations. If America’s engine returns to full capacity sooner, the entire world benefits.

Why the euro may tumble

The euro may find solace in the fact that the European Union has climbed down the tree in its clash with AstraZeneca, with both sides agreeing to a compromise. Moreover, Pfizer promised more jabs.

Nevertheless, the old continent’s immunization attempt is extremely lengthy and European Commission President Ursula von der Leyen’s attempt to promise an acceleration seems to have little credibility. Another delay in Europe’s vaccination campaign and the common currency could be knocked lower.

Eurozone Gross Domestic Product figures for the last quarter of 2020 may also add pressure. The economic calendar is pointing to a decline in output after the third quarter’s rapid recovery, and there are growing fears of a double-dip recession.

A third factor that could tilt EUR/USD lower comes from the US stock market. After posting substantial gains on Monday, shares are set to rise on Tuesday, owing to the reasons described above and also some calm around “meme stocks” such as GameSpot. Concerns about potential downfalls of hedge funds caused sell-offs last week and boosted the safe-haven dollar. The mood is now calm as retail traders are focused on silver prices, but it could change quickly.

All in all, EUR/USD’s weak recovery is telling – and it could turn into snowballing lower.

EUR/USD Technical Analysis

Euro/dollar is suffering from downside momentum on the four-hour chart and trades below the 50, 100 and 200 Simple Moving Averages – all bearish signs.

Critical support awaits at 1.2050, which is a triple-bottom – and the lowest level in 2021. Losing it would send the currency pair to the lowest in two months. The next levels to watch are 1.20, 1.1960, and 1.1930.

Some resistance is at the daily high of 1.2090, followed by 1.2140, which is the convergence of the 50 and 100 SMAs. Further above, 1.2155 and the double-top of 1.2190 await EUR/USD.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750