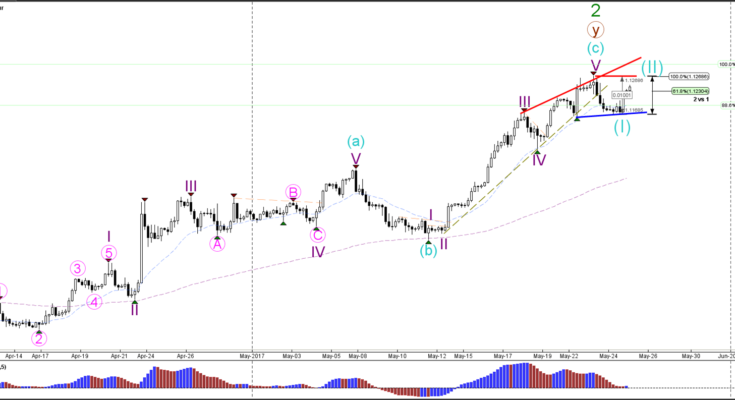

EUR/USD

4 hour

The EUR/USD is challenging the previous top near 1.1250 which is a major decision zone for either a bullish breakout or a bearish reversal. The critical level is the 100% Fibonacci at 1.1268: a break above this resistance top invalidates wave 2 (blue) whereas a break above 1.13 invalidates another bearish wave 2 (green). A bearish reversal, however, could see price break below support (blue).

1 hour

The EUR/USD has arrived at a key 78.6% Fibonacci resistance which is bearish bounce (reversal) or bullish breakout zone.

USD/JPY

4 hour

The USD/JPY break above 112-112.50 would indicate that the wave C (brown) of wave B (blue) is completed at the recent low and could see an uptrend continuation. A break below support (blue) could price complete wave B (blue) at a lower low.

1 hour

The USD/JPY is building a potential wave 4 (orange) correction and a wave 5 (orange) continuation before completing wave C (brown). However if price breaks above the 61.8% Fibonacci level of wave 4 (orange), then a different wave structure seems likely.

GBP/USD

4 hour

The GBP/USD break above the orange trend line indicates the invalidation of wave 2 and the potential for an uptrend continuation whereas but a break below the channel support (green/blue) could see a reversal take place.

1 hour

The GBP/USD is moving sideways in a correction which could be an ABC (orange) within wave 2 (blue).

Â