Video length: 00:01:17

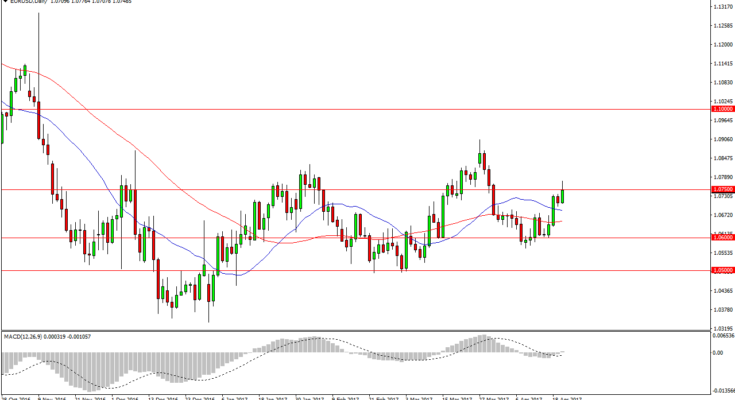

EUR/USD

The EUR/USD pair rallied during the day on Thursday, breaking above the 1.0750 level. If we can break above the top of the candle for the session, I think that is a very bullish sign and should send this market to the upside, perhaps reaching towards the 1.08 level, and then eventually the 1.09 level after that. A pull back from here more than likely will find buyers underneath, and it’s not until we break significantly below the 1.07 level that I would consider selling. Ultimately, this is a market that has a lot of volatility built into it, but longer-term it looks as if we are in a gradual uptrend eating channel.

GBP/USD

The British pound rallied during the day as we continue to consolidate above the 1.2750 level. That area was previously resistive, but at this point should offer quite a bit of support. I think that pullbacks will continue to be buying opportunities, and now that we are above the 200-day exponential moving average, the British pound should continue to rally longer term. I believe that the consolidation is simply an exercise to build up momentum, and the next bullish headline the crosses could be the reason to go higher. Ultimately, I think that the market is free to go to the 1.3450 level above, which is massively resistive. It isn’t that it’s going to be easy to get to, just that I think that’s the ultimate target now. I believe the pullbacks will continue to be looked at as value, and because of this the market should continue to be choppy but positive longer term. The impulsive candle from the session on Tuesday session shows quite a bit of bullish pressure, and typically candles like that mean something longer term. Selling isn’t even a thought currently, and I don’t think it’s going to change anytime soon.