EUR/USD encountered significant pressure, testing a low of 1.0331 before rebounding to 1.0476, as market concerns mount over the potential economic slowdown in Europe and aggressive rate cuts by the European Central Bank (ECB).Recent business surveys indicating an accelerated economic contraction in Germany and France have starkly dampened the euro’s outlook. Additionally, under the newly elected President Donald Trump’s administration, potential new trade duties from the US threaten to exacerbate Germany’s already fragile economic state. Trump’s protectionist stance could notably impact German industries, intensifying existing internal challenges.Investors are bracing for a scenario where the ECB might implement rate reductions more swiftly than anticipated. At the same time, the Federal Reserve may hold steady, expanding the interest rate differential unfavourably against the euro.This backdrop has led to heightened investor nervousness about the euro’s future, with further potential declines in EUR/USD not ruled out amidst ongoing uncertainties regarding the full pricing-in of these expectations.Technical analysis of EUR/USD(Click on image to enlarge)H4 chart: the EUR/USD has hit its projected low at 1.0331, subsequently initiating a rebound towards 1.0500. Upon reaching this level, a pullback to 1.0414 may occur. The market may form a consolidation range around 1.0414, with potential upward movements targeting 1.0570 and possibly extending to 1.0655. This is supported by the MACD indicator, which suggests an impending rise from below the zero level.(Click on image to enlarge) H1 chart: the pair is forming a rise to 1.0500, which is anticipated as an initial target. After this level, a corrective phase towards 1.0414 is expected, suggesting a test from above. The stochastic oscillator corroborates this view, indicating a readiness to descend from a mid-range position towards lower thresholds.More By This Author:

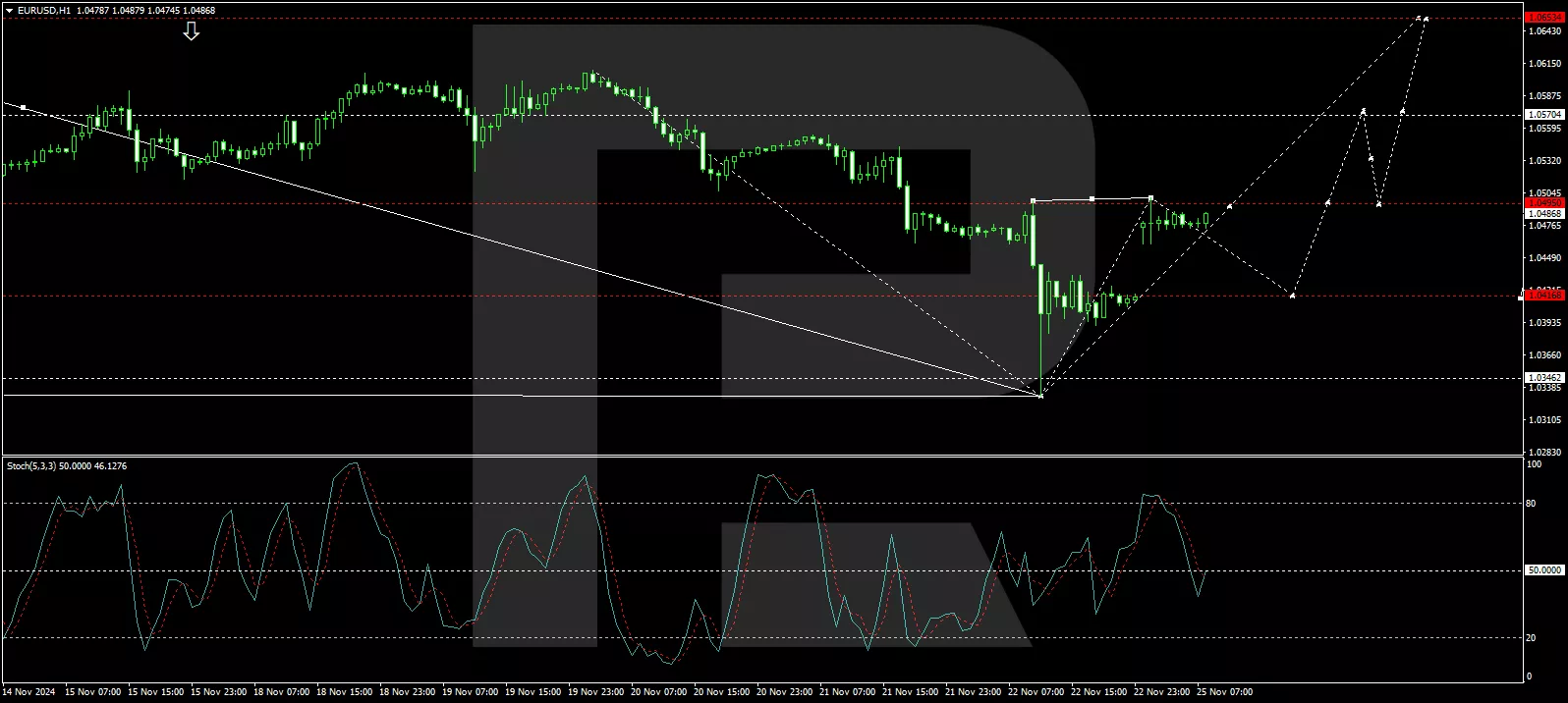

H1 chart: the pair is forming a rise to 1.0500, which is anticipated as an initial target. After this level, a corrective phase towards 1.0414 is expected, suggesting a test from above. The stochastic oscillator corroborates this view, indicating a readiness to descend from a mid-range position towards lower thresholds.More By This Author:

EUR/USD Amid Slowing European Economy