EUR/GBP failed in its attempt to break above 0.9045 resistance and pulled back from 0.9032. The subsequent fall extended to as low as 0.8855, breaking below an important support level at 0.8906 on the 4-hour chart, suggesting that the short term uptrend from 0.8746 is complete.

EURGBP 4-hour Chart

On the downside

The EURGBP pair is expected to test the support level of the 76.4% Fibonacci retracement taken from 0.8746 to 0.9032 at 0.8813. A breakdown below this level could take price to test next support level at 0.8746.

Below 0.8746 level will indicate that the downtrend from 0.9306 has resumed, then next target would be at the 61.8% Fibonacci retracement taken from 0.8313 to 0.9306 at around 0.8690, followed by the 76.4% retracement at 0.8545.

EURGBP Daily Chart

On the upside

Near term resistance is at 0.8930, a break above this level could bring price back to next resistance level at 0.9032. Above this level could trigger further upside movement to 0.9200 area.

For long term analysis

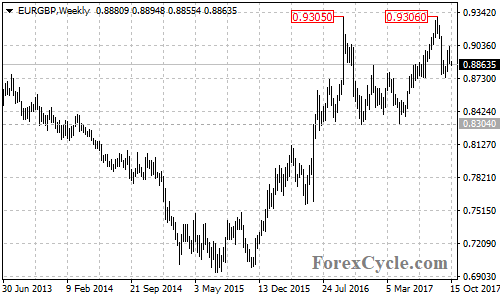

The EURGBP pair seems to be forming a double top pattern on its weekly chart with neckline support at 0.8304. If the neckline support gives way, the following bearish movement could take price to 0.7300 area.

EURGBP Weekly Chart

Technical levels

Support levels:Â 0.8813 (the 76.4% Fibonacci retracement taken from 0.8746 to 0.9032), 0.8746 (the September 27 low), 0.8690 (the 61.8% Fibonacci retracement taken from 0.8313 to 0.9306), 0.8545 (the 76.4% Fibonacci retracement), 0.8304 (the neckline of the double top pattern), 0.7300 (the measured move target).

Resistance levels:Â 0.8930 (near term resistance), 0.9032 (the October 12 high), 0.9200, 0.9306 (the August 29 high).