Last week, board members of the Federal Reserve signaled that they may begin hiking overnight lending rates as early as 2015.  A majority of analysts believe that the message is in line with an anticipated acceleration of U.S. economic growth and a more robust expansion. Similarly, economists polled by the National Association for Business Economics (NABE) foresee a 2.6% bounce in consumer spending here in 2014.

If we’re going to spend more, however, wouldn’t our paychecks need to grow at a faster clip? Wage growth of 0.5% in 2013 compares rather poorly to the near 3% growth from 2012. Additionally, the evidence for wage growth to stage a monster rebound in 2014 is skimpy.

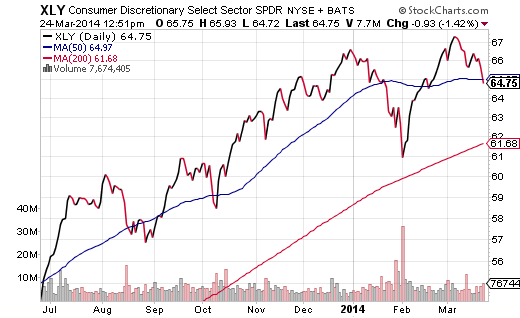

Rock bottom interest rates and falling commodity prices in previous years may have offset a lack of purchasing power. Unfortunately, recent drought woes have sent food costs skyrocketing. Corporations will find it challenging to pass along higher commodity prices to consumers, hurting the prospects for SPDR Select Sector Consumer Staples (XLP). Meanwhile, stagnant paychecks rattled by food and energy inflation might hinder discretionary consumption. An ETF enthusiast should be wary of companies represented by SPDR Select Sector Consumer Discretionary (XLY).

In spite of recent weakness in health care due to massive profit-taking in the biotechnology arena, investors have been questioning the so-called “resilience of the consumer.†Consumer-oriented stocks are weaker than all other stocks over the prior 3 months.

If the Consumer Represents 70% of The Economy, Then…                                        Â

3 Months %