Image Source:

Image Source:

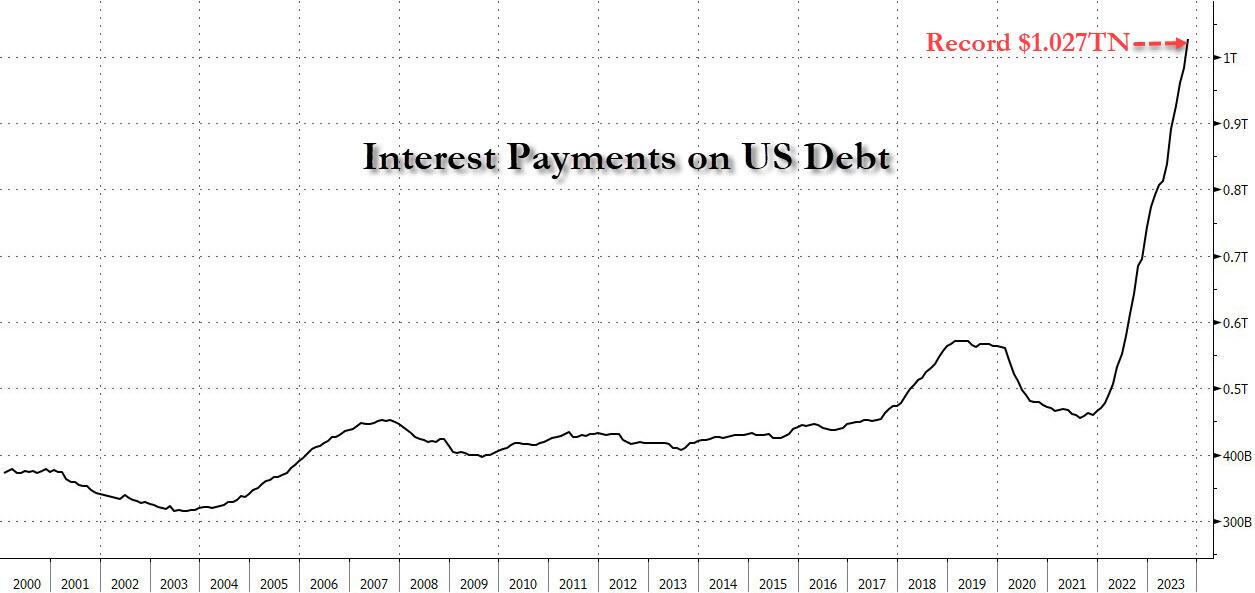

Back in July, when we last looked at the – and concluded correctly, long before the Q2 Quarterly Refunding Announcement that debt issuance was about to explode and yields would soar – we warned that the debt Rubicon was about to be crossed and “US Debt Interest Payments Are About To Hit $1 Trillion.”Fast forward to today when the endgame has apparently arrived: according to the Treasury’s own calculations, total interest is now over $1 trillion (or $1.027 trillion to be precise). We calculated this by multiplying the average interest rate on marketable US Treasury debt (which ) by the $26.003 trillion in marketable US debt () which nets off to $805 billion, and adding to this non-marketable debt interest (which as of Oct 31 was 2.884% multiplied by the amount of non-marketable debt which is $7.696 trillion) and which in turn is an additional $222 billion in interest. Add across and you get $1.027 trillion.Naturally, this calculation of estimated real-time interest costs – which is entirely based on Treasury data – is different than what the Treasury actually paid. Interest costs in the fiscal year that ended Sept. 30 ultimately totaled $879.3 billion, up from $717.6 billion the previous year and about 14% of total outlays, however that number is merely lagging what the pro forma print currently is, and will inevitably catch up to it, and then lag on the other side even as pro forma interest payment start dropping (once interest rates plunge after the next QE/YCC is launched).Fans of exponential functions, we got you covered: the unprecedented surge in both interest rates and interest expense in the past two years means that total US interest has doubled since April 2022 and that’s with the inherent lag in interest catch up – as a reminder, the vast majority of 5, 7, 10 and 30 year debt is still locked in at much lower interest rates, and as such, rates will continue to rise as all of the existing debt rolls into much higher rates over the coming years.Looking ahead, the staggering surge in both yields and total long-term Treasuries in recent months confirms the government will continue to face an escalating interest bill. As a reminder, we were the first to point out that it took just one month after US federal debt first rose above $33 trillion for the first time, to spike by another $600 billion…

We calculated this by multiplying the average interest rate on marketable US Treasury debt (which ) by the $26.003 trillion in marketable US debt () which nets off to $805 billion, and adding to this non-marketable debt interest (which as of Oct 31 was 2.884% multiplied by the amount of non-marketable debt which is $7.696 trillion) and which in turn is an additional $222 billion in interest. Add across and you get $1.027 trillion.Naturally, this calculation of estimated real-time interest costs – which is entirely based on Treasury data – is different than what the Treasury actually paid. Interest costs in the fiscal year that ended Sept. 30 ultimately totaled $879.3 billion, up from $717.6 billion the previous year and about 14% of total outlays, however that number is merely lagging what the pro forma print currently is, and will inevitably catch up to it, and then lag on the other side even as pro forma interest payment start dropping (once interest rates plunge after the next QE/YCC is launched).Fans of exponential functions, we got you covered: the unprecedented surge in both interest rates and interest expense in the past two years means that total US interest has doubled since April 2022 and that’s with the inherent lag in interest catch up – as a reminder, the vast majority of 5, 7, 10 and 30 year debt is still locked in at much lower interest rates, and as such, rates will continue to rise as all of the existing debt rolls into much higher rates over the coming years.Looking ahead, the staggering surge in both yields and total long-term Treasuries in recent months confirms the government will continue to face an escalating interest bill. As a reminder, we were the first to point out that it took just one month after US federal debt first rose above $33 trillion for the first time, to spike by another $600 billion…

One month later:

Total US Debt is now $33.649 trillion, up $58 billion in one day and up $604 billion in one month… up $20 billion every day, up $833 million every hour.

At this rate US debt will be $41 trillion in one year. https://t.co/tOrhqmkFXL pic.twitter.com/UfYOluX1Bq

— zerohedge (@zerohedge) October 18, 2023

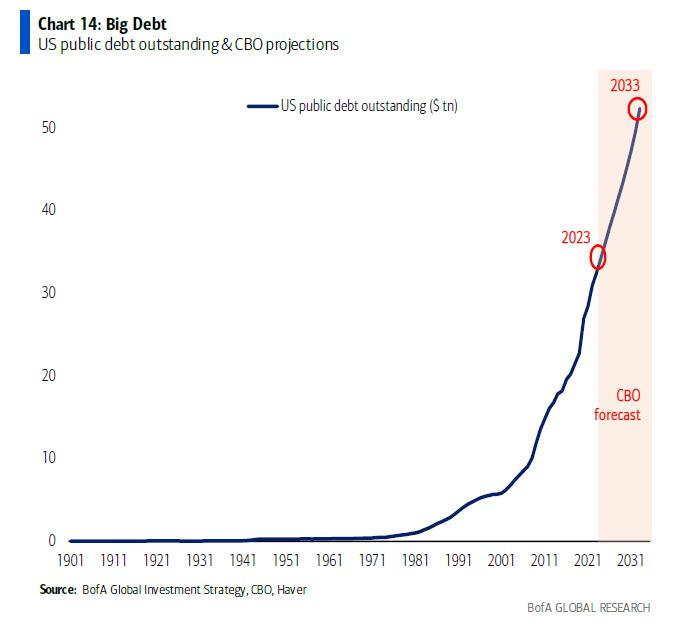

… bringing the total to $33.6 trillion, more than the combined GDPs of China, Japan, Germany, and India.And just to show you how terrifying it is about to get, BofA’s Michael Hartnett notes that “the CBO projects that US government debt will rise by $20 trillion next 10 years, or $5.2 billion every day or $218 million every hour!”

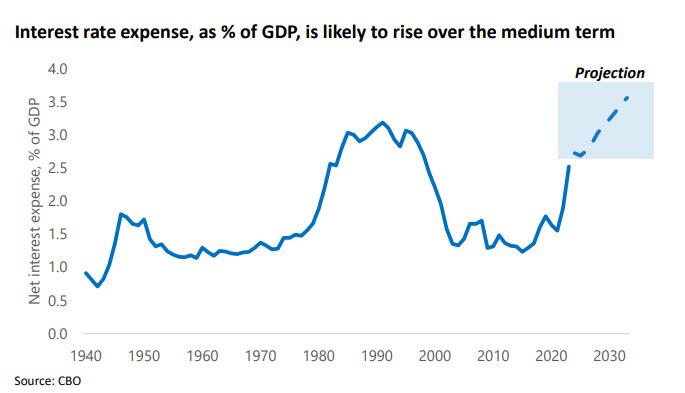

Some more context: total world debt (government, corporate & household) hit a record $227tn in Q1’23, double from $110tn in 2007 & $0.5tn in 1952.And then there was this warning from the TBAC which very tongue-in-cheek said that “Interest rate expense, as % of GDP, is likely to rise over the medium term”, and also over every other term.

As Bloomberg’s Mark Cudmore concludes, the worsening metrics may “reignite debate about the US fiscal path amid heavy borrowing from Washington. That dynamic has already helped drive up bond yields, threatened the return of the so-called bond vigilantes and led Fitch Ratings to downgrade US government debt in August.“An even more damning conclusion comes from Hartnett, Fiscal excess in the 2020s is adding to already high levels of government debt; until policy makers address the trajectory of government debt, investors are likely to worry that asset-bearish solutions to indebtedness such as inflation, default, currency debasement, are set to be pursued; but as likely central banks may simply bail out governments in coming years via QE & the introduction of YCC (policies that would be v US dollar negative).Finally, as we explained yesterday (see “”), the US treasury market was this close to collapse as recently as last week, and if it hadn’t been for some clever language and sleight-of-forward-guidance by the Treasury, in the latest TBAC statement, the endgame for US debt would now be in play. For now, however, it has been merely delayed.More By This Author:Disney Stock Rises After Earnings Beat, Increases Cost-Cutting Plan By $2BNFutures Flat Ahead Of Closely Watched Powell SpeechWTI Extends Losses After API Reports Biggest Crude Build Since Feb