Downward revisions to economic growth going forward have little to do with the weather in the first few months of the year. Yet economists are already concluding that gross domestic product (GDP) in the second, third and fourth quarters will be lower than originally anticipated. Similarly, the National Retail Federation (NRF) is blaming the so-called “trajectory†of 12 months of sales on the extreme weather patterns in January and February. This is giving the organization cover for less rosy sales results in the remaining 10 months of 2014.

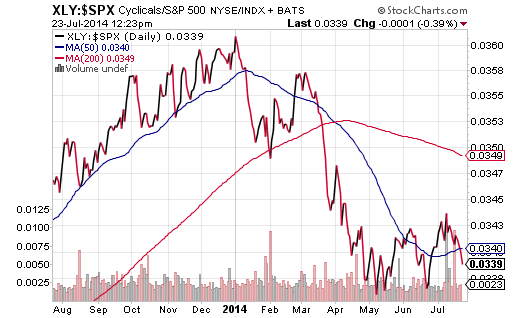

Naturally, consumer discretionary stocks and retailers have nor responded well to the news. SPDR Select Consumer Discretionary (XLY) remains one of the more dismal participants in the sector field and the XLY:S&P 500 price ratio only amplifies the weakness of the consumer relative to the broader U.S. stock market.

At first blush, it is almost as if the broader market refuses to take notice of the struggling consumer. Are investors genuinely impressed, then, with the 288,000 jobs added by employers in June? Probably not. As many as 523,000 full-time jobs were lost in the same month. One in four Americans are now working part-time. And roughly 40% of year-over-year job creation has come in retail, food services or temporary assignments.

No, if investors liked the idea that GDP growth has been decelerating every year since 2012 — if they believed the jobs picture offers genuine hope for a renaissance in wage growth — retail and consumer-oriented equities would be booming rather than flailing. From my vantage point, the U.S. Federal Reserve will use incoming data as reason to maintain its zero percent interest rate policy longer. All the chatter about a rate hike coming sooner in 2015 rather than later is exactly that — chatter. The sluggish economy and the cash-strapped consumer will encourage the Fed to stick with its 0% guidance for a longer period than some are talking about, emboldening risk-takers to bid the markets up to new heights.