If the U.S. economy and the global economy were truly in good shape, why is the SPDR Gold Trust (GLD) performing so admirably in 2014? If  U.S. economic expansion as well as gross world product were actually succeeding, why is Vanguard Extended Duration Treasury (EDV) the envy of capital appreciation seekers? Lastly, if geopolitical tensions are genuinely easing in Ukraine, why are European ETFs still underperforming other regional stock assets?

We can take the first two questions together. Neither the current set of circumstances in the U.S, nor the world at large, suggest genuine economic improvement. Stateside, for example, inflation-adjusted median family income has dipped during the five-plus year recovery and more working-aged-individuals have left the workforce than have joined it. Central bank monetary policy to reduce lending rates gets the award for boosting stock and real estate assets. However, now that the U.S. Federal Reserve is set to exit emergency-level stimulus, investors have been seeking ways to protect themselves. Enter GLD and EDV.

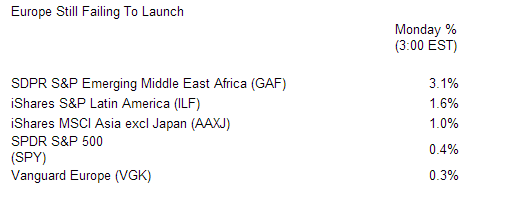

The third question is a shot across the media bow. Visit any financial web site to discover that Monday’s follow-up stock rally is supposedly attributable to Russia backing away a bit from Ukraine. News of this nature could be expected to bolster the fortunes of European equities more than all others. Instead, European stocks are the least successful performers on the world stage. The reason? Italy has fallen back into a recession, while both France and Germany are showing signs of respective slowdowns. France (EWQ) and Germany (EWG) are each below respective trendlines; both have corrected by at least 10%.

Granted, wars around the globe – Iraq, Gaza, Ukraine, Syria, Algeria – have created more demand for safe havens like gold and U.S. Treasuries. Yet before the escalation of these conflicts, long-term yields were falling and gold prices were either climbing or holding steady. Poor performing commodities via PowerShares DB Commodities (DBC) and European woes are more directly tied to economic contraction concerns across the globe.