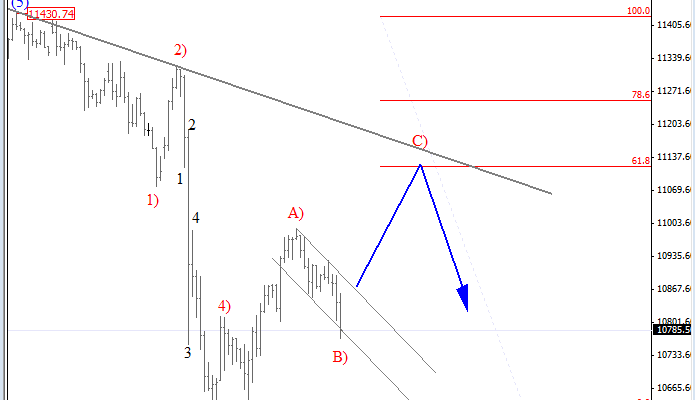

Stocks moved slightly lower in the last few sessions dragging USDJPY with it, but on both markets we see the move as a temporary pullback within an ongoing uptrend. On German DAX we expect a minimum three wave rise away from 10628, but for now that’s not the case yet, as we see a price action in wave B) down, so traders must be aware of a wave C) rally to around 11000 or even 11100 area before the corrective recovery could be finished. So for the short-term view, traders must be aware of higher prices.

German DAX, 1H

If DAX will go up in wave C), then USDJPY can also find some support soon. In fact, the wave pattern is also pointing higher after the recent rally from 122.30 where we called the end of a triangle in wave (iv). Despite that, we have seen a nice pullback in the last 24 hours, which looks like a three wave decline in wave ii) that may look for a support around 122.80-123.00 area. At the same time, there is a bullish head and shoulders formation that is pointing higher as well, while 122.29 holds.

USDJPY, 1H