German DAX

DAX hit the lower trend line of a wedge pattern where wave 5-circled can be looking for a bottom. Notice that wave 5 represents a final leg within wave C of wave IV). So if we are correct, then we know that downside is limited, so ideally price will continue up from 8600-8800 area. But as always we need to be careful with bullish calls until we see a five wave rise from the low. Only an impulsive turn and a break above 9610 will confirm a bullish scenario.

German DAX, 4H

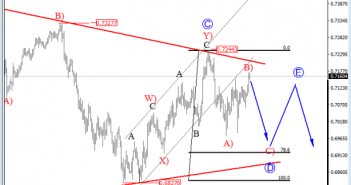

AUDUSD

AUDUSD has turned nicely at the start of February from 0.7240 where the pair topped out after seven legs of recovery from January lows. Recovery was overlapping and slow so we labeled it as a corrective move, probably it was wave C within a big triangle so new three wave decline can now be in the cards. If we are correct, then traders should be aware of a decline even back to 0.6800-0.6900 area while highs from last week at 0.7240 are not breached.

AUDUSD, 4H