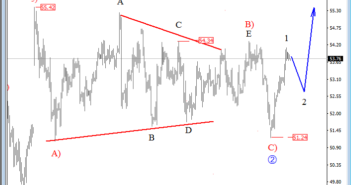

Crude Oil

Crude oil is moving sideways since December, so we are very confident that this is just a contra-trend move within a higher degree uptrend, since last week, showing signs of a completion. As such, we are looking at a new bullish rally that occurred from the 51.24 level, labeled as an ongoing wave 1 which can face a temporary correction in the upcoming wave 2. That said more gains may be in store for Oil.

Crude Oil, 4H

German DAX

A sharp turn down from 11890 on DAX suggests that the index might have accomplished a five wave movement within the extended blue wave 3 and that the current reversal represents a corrective structure in wave four. We are observing an idea of a three wave A-B-C structure with the current price still trading in sub-wave B, if we consider the idea of a flat correction as a the decline from 11724 was made in three waves, thus a sub-wave b of B. That being said, some resistance can now show up around the 11724-11796 zone, from where a new drop into wave C may follow.

German DAX, 4H