AUDUSD has turned down from 0.7834 high in May after wave C-circled completed a big corrective wave IV flat pattern. A flat has a 3-3-5 sub-wave structure, so it was a contra-trend movement that should send the price back to the lows. So far, the market made a very good and strong bearish turn to 0.7130 with a clearly impulsive personality, thus we believe that a big black wave V is underway.

AUDUSD, Daily

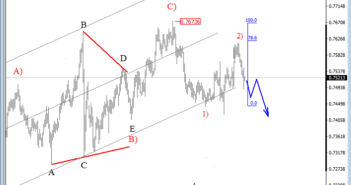

On the lower time frame, we see that Aussie has been trading higher at the start of this month, towards the 0.767 area, from where a 230 pip drop occurred, giving us the idea that the corrective blue wave 2 may be completed. That said we labeled this first impulsive decline as red wave 1) and its contra-trend development as wave 2) that seems completed, as the price made a nice sharp overnight reversal towards the 0.7500 region from our Fibonacci ratio, which could suggest that more weakness could be in the cards in the seasons to come.

AUDUSD, 4H