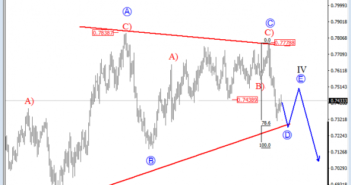

A Elliott Wave triangle is still unfolding on the daily chart, currently in wave DÂ that can be looking for a support in the weeks ahead, near the lower red trendline around the 0.7250 zone, where Fibonacci of 78.6 could prove to be a nice region of support. Ideally, the market will make a final bounce up into wave E from that zone to complete wave IV by the end of the year.

AUDUSD, Daily

Regarding the 4h view, we can see that Aussie has turned down a few weeks back, from 0.7778 to be exact, from where the sharp turn suggests that the pair can still be trapped in a very big triangle formation visible on a daily chart. If that’s true, then the move down from the start of November was another three wave decline, this time in wave D that shows signs of completion at 0.7310 area, so the current leg up is wave E, final leg in wave IV triangle that can face resistance later this week at 0.7600-0.7700 region.

AUDUSD, 4H

Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3. They appear to reflect a balance of forces, causing a sideways movement that is usually associated with decreasing volume and volatility.

Basic Triangle Pattern: