EURUSD

Good morning traders. Stocks are trading higher overnight on the world markets. This week we have NFP on Friday as the most important event. Today during the early morning China manufacturing data came in line with expectations and later today we have ISM manufacturing data in the US. USD is still trading lower but we think this move is limited and are waiting for sings of a reversal. Maybe the NFP on Friday will be the catalyst. On the intraday chart of EURUSD we see that the price is trading higher in the wave c) as we expected. So now we believe black wave E or 2 could be near completion and a new sell-off may occur. That said 1.1028 break will be a sure sign we are heading lower.

EURUSD, 1H

S&P500

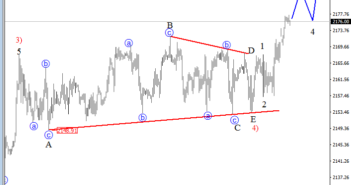

S&P500 broke out of the triangle correction overnight as expected. As we know the triangle should be the last consolidation in the fourth wave, before a reversal in the final wave five may occur. Our target for the current wave 5) comes in around 2.185-95 region where some resistance should be found and a possible reversal may occur.

S&P500, 1H