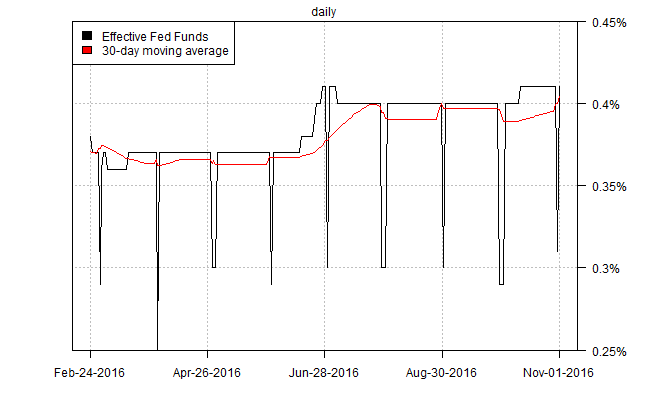

The Federal Reserve yesterday left interest rates unchanged, but the monetary policy statement issued by the central bank on Wednesday hinted at the possibility of a rate hike in December. A day earlier (Nov. 1), the 30-day average of the effective Fed funds rate inched above 0.40% for the first time in eight years.

“The committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives,†the Fed explained in its FOMC statement. But do actions speak louder than words? If so, the new eight-year high in the 30-day average of the effective Fed funds (EFF) rate may be a telling clue.

EFF is a market-based measure of overnight interest rates on loans between banks. It’s also a widely monitored benchmark that’s considered as a predictor of changes in the target Fed funds rate, which is set by the members of the Federal Open Market Committee (FOMC). The current target rate is a 0.25%-to-0.50% range. If EFF continues to move closer to the upper end of that range, the probability of a rate hike increases. Separately, Fed fund futures are pricing in a 72% probability that the central bank will tighten policy next next month, based on CME data for Nov. 2.

The Fed is “still pointing to a December hike, they just didn’t pre-commit to it,â€Â advised John Canally, LPL Financial’s investment strategist and economist.

The Treasury market, however, isn’t convinced that a rate hike is fate for next month’s FOMC meeting. The policy sensitive 2-year yield dipped to 0.81% on Wednesday (Nov 2), a 10-day low, based on daily numbers via Treasury.gov.

One factor that may have weighed on yields yesterday is Wednesday’s report of weaker-than-expected growth in private-sector payrolls in October, according to ADP’s estimate. US companies added 147,000 workers last month, moderately lower than the 170,000 consensus forecast via Econoday.com and well below September’s upwardly revised gain of 202,000. “Job growth remains strong although the pace of growth appears to be slowing,â€Â said Mark Zandi, chief economist of Moody’s Analytics, which co-produces the data.