Our January 2013 Economic Forecast continues to show a growing economy – but growing at a slower rate than last month. Most portions of our economic model are expanding.

Our January 2013 Economic Forecast continues to show a growing economy – but growing at a slower rate than last month. Most portions of our economic model are expanding.

Â

- Since the last forecast, there have been two monthly releases of disposable personal income and expenditures. Â The gap between income and expenditure growth, which had closed, Â has now reopened at an accelerating growth rate. Econintersect considers this a headwind to economic growth in January 2013. Note that our quantitative analysis which builds our model does not include personal income or expenditures.

- Econintersect checks its forecast using several alternate monetary based methods – and the check forecasts confirm our non-monetary based forecast.

- Note that all the graphics in this post auto-update. The words are fixed on the day of publishing, and therefore you might note a conflict between the words and the graphs due to backward data revisions and/or new data which occurs during the month.

This post will summarize the:

- leading indicators,

- predictive portions of coincident indicators,

- review of the technical recession indicators, and

- interpretation of our own index – Econintersect Economic Index (EEI) – which is built of mostly non-monetary “things†that have been shown to be indicative of direction of the Main Street economy at least 30 days in the future.

Consider:

- The consumer is still consuming. This year (2013) is only the fourth period in history where the ratio of spending to income has exceeded 0.92 (April 1987, the months surrounding the 2001 recession, from September 2004 to the beginning of the 2007 Great Recession, and now). Currently this ratio continues above 0.92 – and remains high historically. This high ratio of spending/income will act as a constraint to any major gain in consumer spending absent any increases in income.

Seasonally Adjusted Spending’s Ratio to Income (a declining ratio means Consumer is spending less of Income)

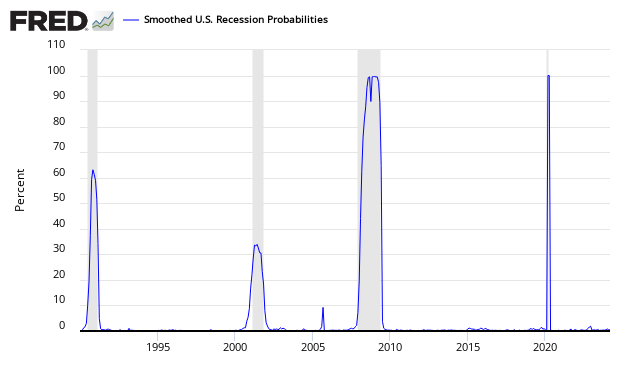

- The St. Louis Fed produces a Smoothed U.S. Recession Probabilities Chart which is currently giving no indication of a recession.

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. This model was originally developed in Chauvet, M., “An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching,†International Economic Review, 1998, 39, 969-996. (http://faculty.ucr.edu/~chauvet/ier.pdf)

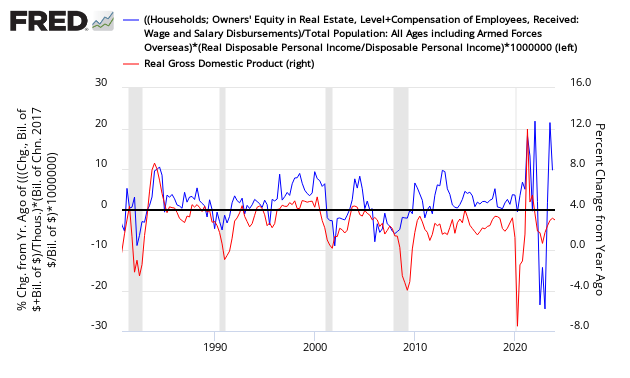

- Joe Sixpack’s economic position is strengthening – albeit at a slowing rate of growth. The Econintersect index’s underlying principle is to estimate how well off Joe feels. The index was documented at a bottom in the July 2012 forecast. Joe and his richer friends are the economic drivers.  Joe is the blue line in the graph below, and that is not close to the levels associated with past recessions. Note this index is updated every quarter.

Joe Sixpack Index (blue line, left axis)

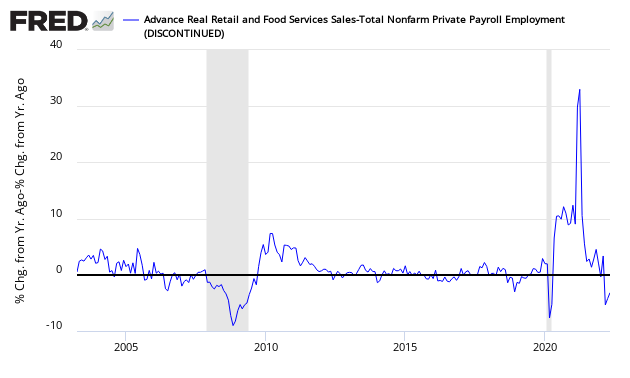

- Econintersect reviews the relationship between the year-over-year growth rate of non-farm private employment and the year-over-year real growth rate of retail sales. The short term trend is now mixed depending on the periods selected. As long as retail sales grow faster than the rate of employment gains (above zero on the below graph) – a recession is not imminent.

Growth Relationship Between Retail Sales and Non-Farm Private Employment – Above zero represents economic expansion

- Most economic releases are based on seasonally adjusted data which is revised for months after issuance so a contraction in a particular release may not be obvious for many months.

The Leading Indicators

The leading indicators are monetary based to a large extent. Econintersect‘s primary worry in using monetary based methodologies to forecast the economy is the current extraordinary monetary policy which may (or may not) be affecting historical relationships.

Econintersect does not use data from any of the leading indicators in its economic index. All leading indices in this post look ahead six months – and are all subject to backward revision.

ECRI’s Weekly Leading Index (WLI) – Econintersect is now ignoring ECRI’s recession call as it is obvious it is no longer relevant. ECRI’s WLI index value remains marginally above zero (but continues to degrade in the last few weeks) which according to their definition means the economy six month from today will be better than today. A positive number shows an expansion of the business economy, while a negative number is contraction. The trends in 2013 have remained in a very narrow slightly positive channel.