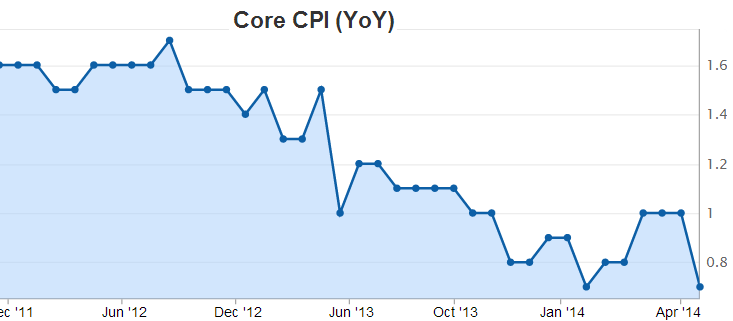

The ECB received another set of disappointing inflation reports today. For some time now the central bank has been betting on the fact the declining inflation figures were driven by food and energy, while the core CPI rate was recovering. Well, that didn’t turn out to be the case, at least for now.

Eurozone core CPI (source: Investing.com)

With the euro remaining at lofty levels, the ECB is beginning to prepare the markets for new monetary stimulus, as the various officials discuss “unconventional” policy.

Weidmann:

BW: – After building a reputation as a nay-sayer on the European Central Bank’s Governing Council, the Bundesbank president’s [Jens Weidmann’s] support for large-scale asset purchases marks a shift that helps the fight against deflationary threats. His tentative backing of quantitative easing will shore up its credibility as officials debate whether they need to implement it.

Coeure:

WSJ: – “Should further monetary accommodation be needed, it is reasonable to consider other operations aimed at lowering the term premium. This is where targeted asset purchases enter the toolset of monetary policy,” Mr. [Benoit] Coeure said in prepared remarks to an International Monetary Fund conference.

Nowotny:

WSJ: – Mr. [Ewald] Nowotny, who is a member of the ECB’s governing council, signaled that his preference would be for any ECB stimulus to be geared toward Europe’s asset-backed securities market, which may in turn boost the flow of credit to the economy. He said he is open to setting a negative rate on bank deposits parked at the ECB, but raised doubts about the effectiveness of such a move.Â

“We are preparing all the technical aspects of a range of possible interventions,†Mr. Nowotny told The Wall Street Journal on the sidelines of meetings of the International Monetary Fund.

Of course there doesn’t seem to be an agreement on the type of unconventional policy the central bank will undertake. Things like a negative deposit rate for example have been discussed. But if the decision is to buy assets, what types of assets would the central bank focus on? Some of the recent discussions centered around ABS securities and other types of bonds that would provide credit to smaller and medium-sized businesses. The problem with this strategy is the market size. Thanks in part to Basel capital rules, the ABS market in Europe isn’t sufficiently large (Basel regulators have referred to these securities as “toxic”). And since only the higher rated paper qualifies for ECB collateral (which is presumably the only bonds that the central bank would be permitted to buy), there isn’t enough to have a credible QE program.