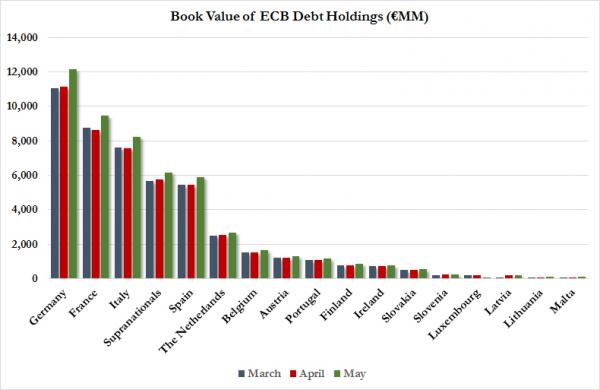

Two weeks ago, we followed up on the unprecedented ECB leak to hedge funds in which Coeure told a select group of hedge funds the market moving information some 10 hours before disclosing the news publicly, that the ECB would front-load its monetizations under the PSPP program in May and June (due to “seasonal factors”, clearly the ECB did not want to admit that the acceleration in May/June purchases is because that is when European net issuance is highest and the entire ECB QE program was terribly conceived in a continent with no excess eligible collateral). We found that just as the ECB leaked, May purchases indeed jumped by a quite substantial 9%, mostly across German, French, Italian and Spanish sovereign bonds.

Â

As a reminder, May was the month when the Bunds suffered the biggest yield surge in history, and many were worried that the ECB was about to lose control of the situation leading others to speculate that the only reason the ECB boosted its QE was to prevent further a plunge in Bunds, even as the ECB clearly desired a Bund yield far above the 0.0% it nearly touched 2 months ago, as a negative Bund yield would make it virtually impossible for European QE to continue excluding further cuts to the deposit rate.

Well, May came and went, and the Bund plunge and yields stabilized, which means that despite (or perhaps due to) Draghi’s recent warning of upcoming market volatility, the sell off in Bunds was permitted to continue: which, again, is precisely what the ECB wants, ideally a 10Y German yield in the low to mid-1% range, not some negative print as a result of everyone frontrunning the ECB which put an early end to the ECB’s QE.

And perhaps just to confirm that Coeure’s infamous leak had nothing to with seasonality and everything to do with micromanaging Bund yields, in the latest ECB weekly report, we learned that after purchasing €13 billion in sovereign debt under its PSPP program, in the week ended June 12 this number dropped to just €10.6 billion, a 18% drop from the past week, and a 22% drop from a month ago. This was also the lowest weekly purchase notional since the first week of May.