Introduction

Ever since 2007 when Xinyuan Real Estate (XIN) became the first Chinese real estate developer listed on the New York Stock Exchange, its low price has been something of a mystery. After being launched at $16.50, it fell to a low of $1.67 in 2008, and recently has been trading in the low $2 to high $3 range.

The mystery has to do with the fact that at $3.90, its dividend rate is 5% with plenty of coverage but its price/earnings ratio is only 4. Sure, it is a Chinese company and FocusEconomics projects China to grow at only 6.5% this year. And yes, earlier on, there was a bit of musical chairs in the CFO position leading to concerns about the legitimacy of its financial data.

But much of this would appear to be resolved. George Liu has been the CFO for almost a year, and XIN has made steps to attract more foreign interest. It launched what should be a successful luxury apartment project – Oosten in the Williamsburg section of Brooklyn. And last summer, Liu and May Chen, the head of Investor Relations, attended a conference in New York with other real estate investors. In addition, XIN put out an extremely informative report on its real estate market and current investments last November available on its website.

In time, these public relations issues should help provided their numbers remain promising. And it is to the 4th quarter results that I now turn.

Basic Numbers

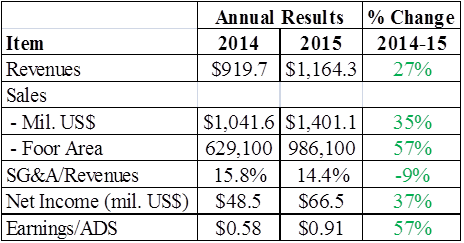

The 12-month numbers look good. As Table 1 shows, everything that is supposed to be up is up and costs are down. And there is plenty of earnings coverage for a $0.20 annual ADR dividend. But this is no reason to get carried away. As I said in an earlier piece, “being better than 2014 is testament to just how bad a year 2014 was for Chinese real estate.â€

Table 1. – XIN Annual Financials

Source:Â Xinyuan Real Estate

However, the quarter-to-quarter numbers include some worrying signs. Table 2 gives quarterly data and changes therein. Revenues, sales, and floor area are up and costs as a share of revenues are down – all good. But income and earnings per share are down. This could only happen if prices fell. CFO Liu was asked about this at the press conference following the release of the fourth quarter figures. He said “margins fellâ€. He suggested it was good to get rid of the low margin properties, even if it had to be done at lower prices.