After so many years investing in a bull market, we tend to forget things can go wrong. Some people are afraid and stay on the sideline, but most of us keep investing. After all, those who have been waiting since 2012-2015 have already lost an opportunity they will never be able to recuperate.

As our portfolio goes up, we tend to become greedier. +7% is not enough anymore, we want double-digit growth. This is what pushes many investors to take additional risks and aim for the sky for each transaction. I’m not this type of investor. I follow a meticulous investing approach that has paid me well for many years. However, I must admit that we all tend to forget what the worst can look like after so many years of profit.

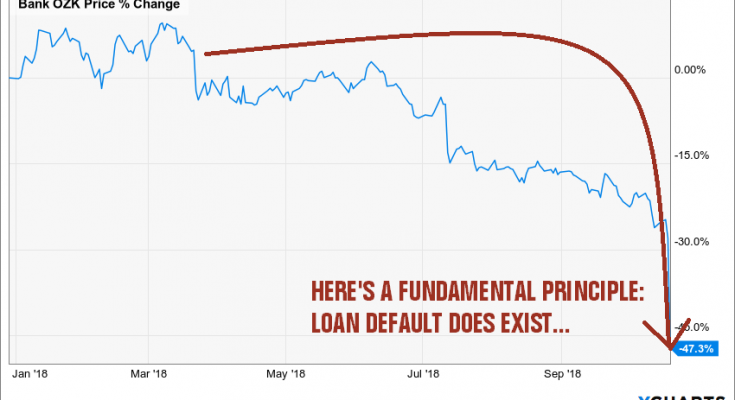

Last week, I hosted a free webinar discussing 10 dividend growth stock picks (you can watch the free replay here). Those companies have been down since the beginning of the year and showed a great potential going forward. After all, great companies get ignored by investors all the time. This is what creates buying opportunity. Life is full of irony. One company I discussed in this webinar was Bank of OZK (OZK). A few hours after my webinar, the bank disclosed their latest quarter. Here’s what happened:

Source: Ycharts

But before I tell you what happened, let’s take a quick peek at OZK:

Bank OZK in a nutshell

In 1903, Bank of the Ozarks, a small bank in Jasper, Arkansas, was founded. Things greatly evolved when OZRK went public in 1997. It started growing organically through multiple mergers & acquisitions. In 2018, Bank of Ozarks changed its name to Bank OZK to reflect its ambition of growing across the U.S. It mainly operates around savings and loan banking. The bank currently has 253 offices in 10 U.S. states. While lots of its offices are in Arkansas, Georgia, and Florida, its NYC facility owns the largest part of its loan portfolio.

The small bank that sees big has a strong reputation in the savings and loan banking industries. As a classic one, OZK is well positioned to benefit from the U.S. economic tailwind. The Tax Act should also boost earnings and open the door for more acquisitions. With the interest rate spreads improving, OZK should show strong numbers going forward. Finally, its Real Estate Specialties Group is a loan growth machine. OZK is leaving the crowded loan activities to focus on Real Estate Specialties. As the construction industry is healthy, RESG should be able to have solid results.