US economic data has been a bit wobbly lately—the unexpected slide in February retail sales, which marks the third straight month of red ink, for instance. The optimists say this is just a soft patch for spending, weighed down by a harsh winter. The broad trend in most other indicators implies as much, including the upbeat numbers for payrolls. Perhaps, then, it’s no surprise to find that the real monetary base for the US continued to decline through February, laying the groundwork for the Federal Reserve’s first interest rate hike in nearly a decade. The arrival of policy tightening could come as early as June, according to some forecasters… assuming, of course, that economic growth holds up.

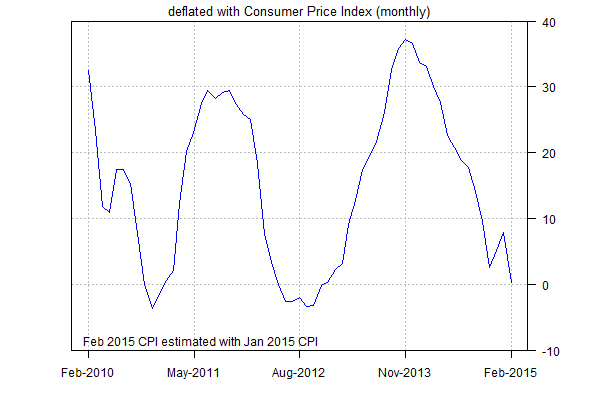

The recent deceleration in the growth rate in the real (inflation-adjusted) supply of so-called high-powered money or base money (M0) provides quantitative evidence that the central bank is continuing to wind down its stimulus efforts of recent years. The St. Louis Adjusted Monetary Base (deflated by the consumer price index) was nearly flat on a year-over-year basis through February 2015—a dramatic fall from the 30%-plus increases in late-2013 and early 2014. (Note that the Feb. 2015 CPI report will be published later this month; meantime, I’m using Jan. 2015 data as an estimate for last month’s inflation numbers. Otherwise, historical CPI figures are used to deflate M0.)

The sharp deceleration in the annual growth rate of the monetary base alone isn’t a guarantee that that the Fed will start hiking its policy rate in the near-term future, but it’s a telling clue. More context is due next week (Wed., Mar. 18), when the central bank will publish a new FOMC statement, which will be followed by Janet Yellen’s press conference and a fresh set of economic projections.

Meantime, how should we interpret the recent trend in the monetary base? True, it’s only one clue and should be read within a broader context of economic and monetary data. That said, it’s likely that whenever the Fed decides to start hiking rates the change will arrive in the wake of a conspicuously lesser rate of growth in the monetary base, which certainly describes recent history.