The Q4 earnings season has gotten off to a good start, with earnings and revenue growth tracking above other recent periods and on track to reach the highest level in eight quarters. Positive surprises, particularly on the earnings front, are a bit on the low side relative to historical periods at this stage. We will see if this trend continues this week as we enter the heart of the earnings season, with more than 300 companies coming out with quarterly results, including 105 S&P 500 members.

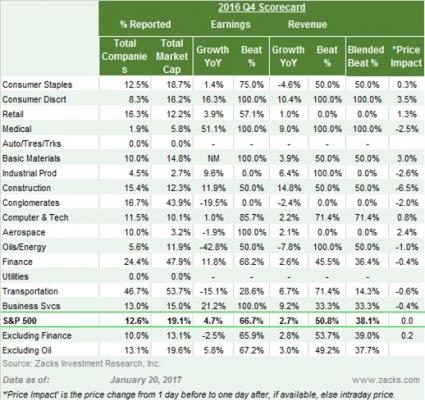

As of Friday, January 20th, we have seen Q4 results from 63 S&P 500 members that combined account for 19.2% of the index’s total market capitalization. Total earnings for these 63 index members are up +4.7% on +2.7% higher revenues, with 66.7% beating EPS estimates and 50.8% coming ahead of top-line expectations.

The table below provides the current Q4 scorecard

The charts below provide a comparison of the results thus far with what we have seen from this same group of 63 S&P 500 members in other recent periods.

As you can see, the Q4 growth pace is notably tracking above what we had seen from the same group of 63 index members in other recent periods. But positive surprises (right-hand chart above) are tracking a bit on the low side at this stage, particularly on the earnings side. The 66.7% proportion of Q4 companies beating EPS estimates compares to 81% in the preceding quarter, 75% as the 4-quarter average and 71.3% as the 12-quarter average. Positive revenue surprises are tracking below what we had seen from the same group of companies in Q3, but are roughly in-line with historical periods.

The chart below compares the proportion of companies reporting Q4 results that are beating both EPS and revenue estimates with what this same group of companies had reported in other recent periods.

Trump Bump for Banks

The sample of Q4 earnings reports is heavily weighted towards the Finance sector at this stage whose improved results are helping the aggregate growth picture as well. The growth picture looks a lot less impressive once looked at on an ex-Finance basis.