Here’s an interesting video from the recent James Grant Conference. The title of this year’s conference is Investing Opportunistically, Separating the Beta from the Alpha.Â

The first five minutes are introductions and attendee notes you may wish to skip over. The opening speech was by Marc Seidner, CFA at GMO, on inflation expectations.Â

Note: you may have to click on the play arrow twice to start the video.

Â

Â

Last year at this time a majority thought tightening was inevitable and bonds were attractively priced for those who thought otherwise, now, tightening in Europe and Japan is totally priced out and even in the US, inflation expectations are down as noted by forward yield curves.

Seidner commented that 100% of strategists were negative on bonds heading into 2014 but I can name a couple exceptions, notably Lacy Hunt at Van Hoisington.

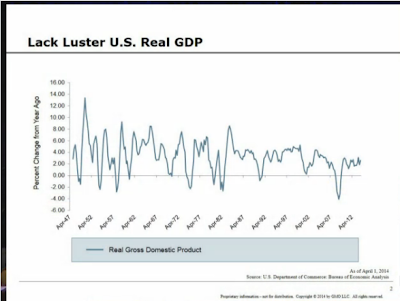

Lackluster GDPÂ

Tepid Inflation – UK, US, EU, Japan

Historically, when inflation has been this low, talk was of easing further not tightening.

Inflation Expectations

One-Year Inflation Expectations

US Dollar, Euro, Yen, British Pound Forward Curves

“Europe Has Become Japan”

Seidner says that if he was washed up on an island and could periodically see one chart to let him know the state of the global economy the above chart would be the one as it shows interest rates, implied path of monetary policy, and the divergence between the US and the rest of the world.

“From this perspective of the bond market, Europe has become Japan. … There is an inconsistency in my mind between a path of forward interest rates that Europe that reflects such slow economic growth that interest rates never get off zero-bound… that there will be enough growth to enable high-debt countries to delever safely is a complete inconsistency,” said Seidner.

James Grant on Price Discovery and Inflation

James Grant takes the podium at about the 25 minute mark with a joke about the title of his publication, Grant’s Interest Rate Observer.Â