Introduction

The media is doing a more than adequate job of covering the futile dance between the Eurozone “leaders†and Greece. But Greece is not the only country facing fundamental economic challenges. This article identifies other countries in the most dire straits and the problems they face.

Methodology Used to Select Countries in the Most Trouble

To select countries, five key indicators were selected: GDP growth rates, unemployment rates, government deficits, government debt, and current account deficits. Declining or negative GDP growth rates are often a precursor of emerging economic problems. High unemployment rates mean problems already exist. High government deficits means a country’s ability to generate additional fiscal stimulus are limited: the deficits lead to higher government debts, debts that can become unsustainable. Current account balances are the sum of trade and capital flows. Countries can only run negative current account balances until they have depleted their international reserves.

The IMF collects these data on 189 countries. For purposes here, countries with populations of less than 500,000 were dropped. Then, the 30 countries with the worst 2014 performance on each of these indicators were selected. That narrowed the list to 74 countries. The list was paired further by choosing countries that performed worst on at least 3 of these 5 indicators. That left 12 countries. Those countries along with three others facing somewhat unique problems – Ecuador, Ukraine and Venezuela – are analyzed below. Libya and Syria are not included. Their serious economic problems are primarily attributable to wars. But at least for now, Libya is still pumping oil and Syria receives substantial economic assistance from Iran.

Countries Without Their Own Currencies

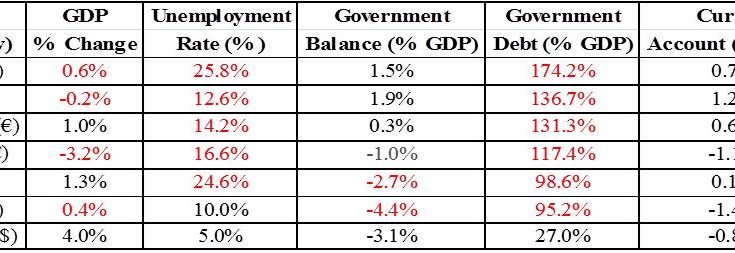

Six countries in our selection use the Euro and Ecuador uses the US dollar. Situations in these countries are most precarious because without having a currency that can weaken, they can literally run out of money. Table 1 lists the six countries in trouble that do not have their own currencies. The numbers in red designate indicators where the country ranked as one of the lowest 30 countries in the IMF database.

Table 1. – Economic Performance Indicators, 2014

Source:Â IMF

The countries, ranked by the size of their government debts, all have somewhat different problems. Greece is in a class by itself: 25% of its workforce is out of work and the debt cannot be sustained. But its greatest problem is that its leaders, the European Central Bank, and Eurozone officials are just sparring with no solution in sight. Italy tends to cruise along under the radar. But it is in a recession with a growing unemployment rate and its debt burden is dangerously high. Media reports suggest that Portugal is “out of the woodsâ€, but is it? With high unemployment and a heavy debt burden, its future is cloudy at best. Cyprus is in a free fall but does not get much attention because of its size. Spain is using deficit finance to reduce its high unemployment rate and does not yet have a high debt burden. Time will tell on whether it works. In recent years, the French economy has been lackluster and its large government deficit has gotten the attention of Eurozone officials. And its current account deficit is also problematic. On the basis of Table 1 data, Ecuador’s problems do not appear serious. Why they are will be explained below.  Â